A home from home

8th April 2017

Help for homebuyers

8th April 2017The Northern Ireland House Price Index

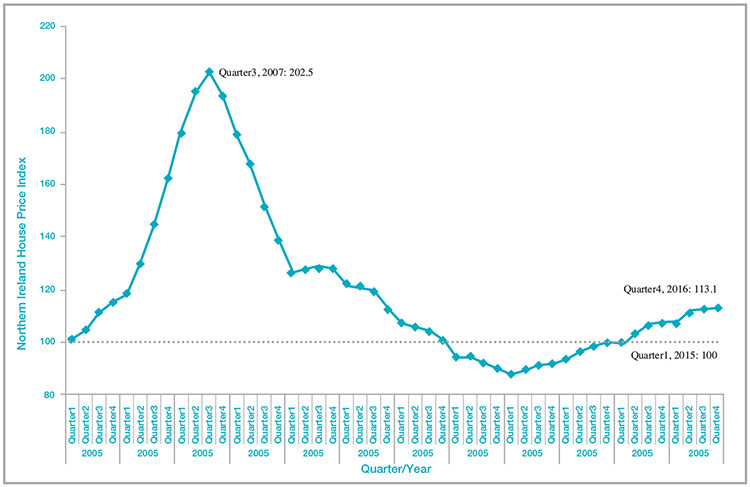

In May 2012, Land & Property Services (in association with the Northern Ireland Statistics and Research Agency) launched its first official House Price Index which charted the change in house prices since 2005. The report also included information on the number of properties sold – an important measure of activity in the housing market in Northern Ireland.

There are two critical aspects to the Northern Ireland House Price Index (NI HPI) which, in combination, sets it apart from the other indices produced on the Northern Ireland housing market. The first is that it is the only measure of the Northern Ireland market which uses information on all house sales – other producers are limited to using samples and many exclude auction and repossession sales. The second is that it uses the internationally-recognised, best practice hedonic regression modelling approach to calculating an average house price.

Initially the NI HPI (or the NI Residential Property Price Index as it was first known) was the only official government House Price Index in the whole of the UK using this specific methodology. The other producers of official house price statistics used different methodologies with different levels of coverage (e.g. samples from mortgage sales).

This led to confusion for users who were presented with estimates for house prices from different official surveys, some of which differed quite starkly. So, it was decided to produce just one official House Price Index for the whole of the UK, which would remove this confusion and allow reliable comparisons.

Taking advice from international experts on the methodology and running a number of consultations with users initially to understand their key needs from the figures and secondly to hear their views on the proposed new methodology, the single official UK House Price Index methodology was developed and then launched in June 2016.

The methodology review confirmed that hedonic regression modelling was still the best methodology for the data that exists in the UK. As a result, there was very little change in the figures produced under NI RPPI methodology and the UK HPI methodology – which was a pleasing outcome! To recognise the move to a single methodology across the UK and to reflect the fact that the NI component of the UK HPI is produced by LPS, the NI RPPI was renamed the NI HPI.

HM Land Registry is now the official producer of the UK HPI, acting on behalf of all four original producers. The UK HPI is published on GOV.uk and links to all the component reports. The website provides access to the current reports, the detailed statistics (both for download and for interactive searching and analysis), the detailed methodology report and a range of other background papers.

https://www.gov.uk/government/collections/uk-house-price-index-reports

The vision of Land & Property Services (LPS) is: “Together delivering excellence and innovation in the provision of land and property services upon which our customers can rely.” LPS is pleased to be able to produce this reliable index for customers and can confirm that the NI HPI continues to be published quarterly and is available either from the Department of Finance, NISRA or GOV.uk websites.

https://www.finance-ni.gov.uk/topics/statistics-and-research/ni-house-price-index

The lead statistician for the NI HPI is Ciara Cunningham.

E: LPS.statisticsbranch@finance-ni.gov.uk