Foreword: The common goal of Housing for All

7th July 2022

Sustainability to the fore in new residential developments

25th October 2022The ‘renter generation’ and future policy implications

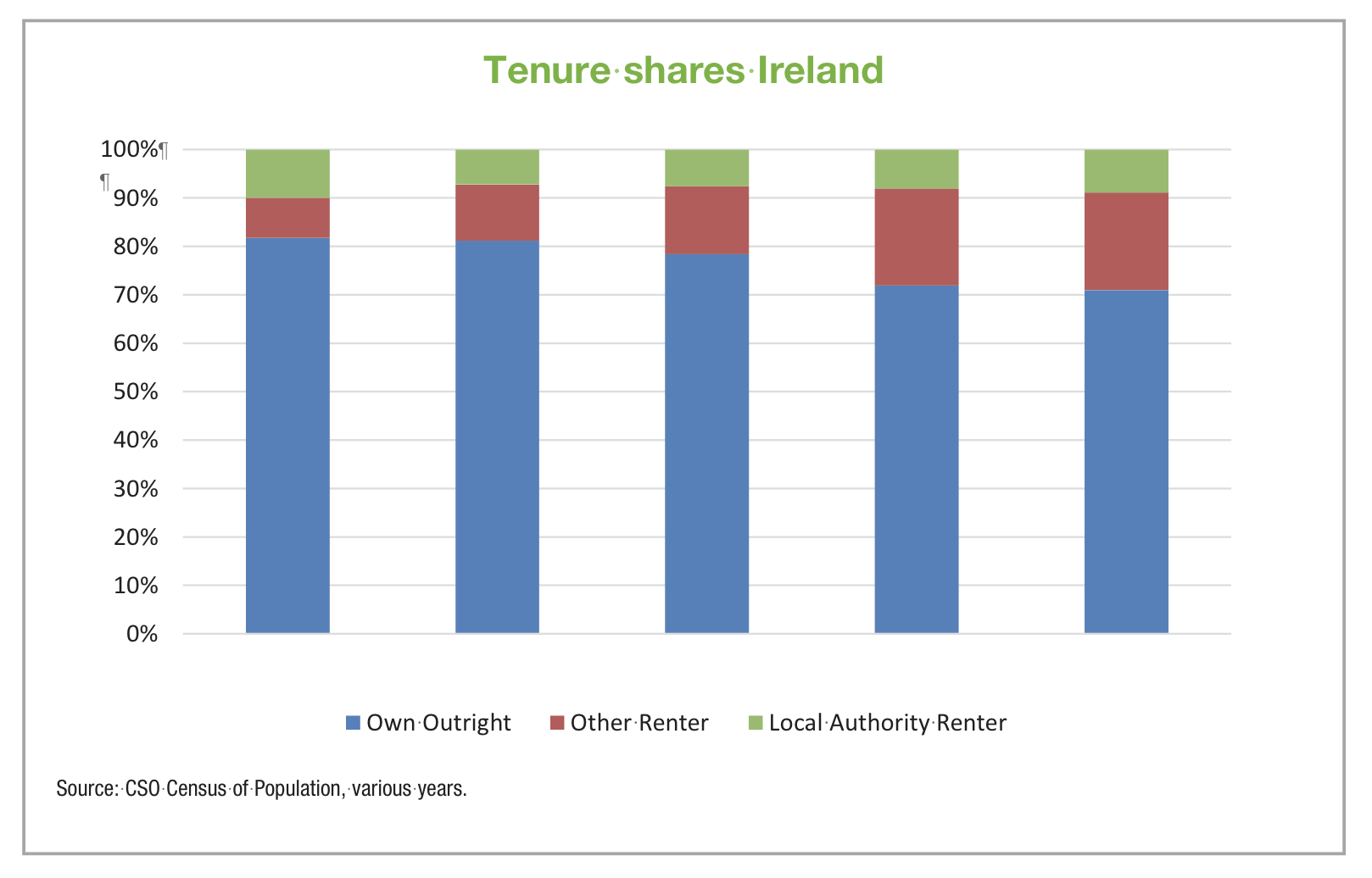

A study by the Economic Social Research Institute (ESRI) has found that homeownership for people aged 25-34 has declined from 60 per cent to under 30 per cent between the Celtic Tiger era of 2005 and 2015, and has predicted challenges for the current generation of renters in getting onto the housing ladder.

The report has revealed further challenges for the younger generations as they retire in the future, namely that homeownership has traditionally sheltered pensioners from additional expenses, and that if the ‘renter generation’ remains unable to access homeownership through their lives, then it will rapidly increase the pressure on the pensions system. Ownership traditionally provides a ‘double dividend’ of reduced expenses and lowering housing costs.

The continued requirement to cover housing costs for renters in retirement can be seen as an additional vulnerability in terms of retirement income adequacy in Ireland, over and above the general concern of sufficient pension income.

Additionally, research by the CSO and Eurostat has found that, over the last decade, homeownership levels have been decreasing more rapidly in Ireland than the EU average, although there has been decline throughout the EU, demonstrating that this is not a problem unique to Ireland. The ESRI has, however, found that homes in the State are overvalued by 7 per cent.

Generational divide in homeownership

Homeownership rates are roughly 10 percentage points lower (approximately 80 per cent) for those currently aged 55-64 and 45-54 when compared with current retirees (approximately 90 per cent), the report states that “this differential is unlikely to close substantially for these groups given their position in the lifecycle”.

The report recommends a reform of the pension system (both public and private) outlining the outdated nature of the current system which is geared towards pensioners who have traditionally been able to pay off a mortgage on a bought home. It outlines that, since projections show that homeownership will be lower for future generations, that consideration should be given toward this when it comes to future policy formulation.

It further critiques the Government’s current housing policies as being “uncertain” as to whether it will increase the levels of homeownership in the State, although it does acknowledge “there is certainly time for policies to influence the outcomes of this research from both a housing tenure and income support perspective”.

The report further emphasises the divide in poverty between younger people and older people in the State, and that the nature of the housing model in Ireland means that houses will only continue to become more expensive.

“Given future demographic projections and associated sustainability challenges, it is unlikely the State will also be able to fully carry the cost burden for the challenge of higher housing costs in retirement. Therefore, developing a policy strategy which mixes lifetime incentives to accumulate retirement assets during employment with an adequate safety net is most likely to be required,” the report states.

Given that homeownership declines as generations get younger, and that the population is continuing to grow in the State, it is difficult to envisage where the end to this problem comes from. Housing for All has the stated objective of providing affordable, high quality housing for every citizen in the State.

Whilst building has increased since the implementation of Housing for All, many of these homes have been acquired by wealthy property developers, thus emphasising the generational divide between the renter generation and the older population who have been able to own their own homes.