The ‘renter generation’ and future policy implications

25th October 2022

2023 mooted as right to housing referendum date

25th October 2022Sustainability to the fore in new residential developments

Hooke and MacDonald, a market leader in the Irish residential market, state that sustainable real estate is a stand-out feature within today’s international real estate industry and that investors and stakeholders are becoming increasingly motivated to acquire properties that have sustainable characteristics, writes Ken MacDonald, Managing Director.

Considering the fact that buildings generate almost 40 per cent of energy consumption globally, with 28 per cent coming from the operations of buildings themselves, most investors around the world are committing to more sustainable practices than previously.

Irish building standards and statutory requirements related to them have been evolving over the last 10 years and this has improved the quality and sustainable characteristics of new residential developments. The housing energy efficiency regulations for new housing that are in force in Ireland are applicable to both new homes and major renovations of existing properties. The European Energy Performance of Buildings Directive (EPBD) introduced new building standards through amendments to Part L of the Building Regulations.

Investor attitudes and demand

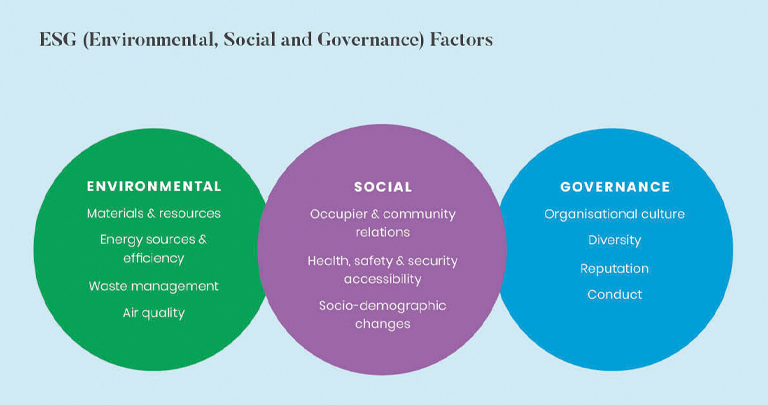

Sustainability and the wider ESG agenda are increasingly front and centre of investment considerations and decisions and is a key priority for regulators, policymakers, investors, and asset managers. Many international companies have appointed sustainability managers and sustainability teams to run a wide range of strategies to comply with their ESG policies and investment mandates which will play an internal role in the evolution of ESG within the asset management industry.

The feedback that Hooke and MacDonald have had from fund managers is that many of the institutional funds are putting money aside for ESG only assets. There is more of a mandate to invest in ESG credential buildings or buildings to be refurbished to hit those credentials. Asset owners, such as pension funds, are increasingly demanding sustainable investing strategies from their asset managers and this ultimately forms an important part of investors underwriting and due diligence assessment.

One of the most globally recognised identifiers of green buildings is through LEED Certification (Leadership in Energy and Environmental Design). LEED provides a framework for healthy, highly efficient and cost-saving green buildings. There are different levels of certification, including a basic certification level, then silver, gold, and platinum levels. Some of the features of a building which are analysed include the following:

- building locations away from environmentally sensitive areas;

- access to public transport;

- access to bicycle storage;

- efficient use of energy, water, and other resources;

- use of renewable energy, such as solar energy;

- pollution and waste reduction measures, and facilitation of re-use and recycling;

- good indoor environmental air quality;

- use of materials that are non-toxic, ethical, and sustainable;

- consideration of the environment in design, construction, and operation;

- consideration of the quality of life of occupants in design, construction, and operation; and

- a design that enables adaptation to a changing environment.

Economic benefits:

- gain competitive edge;

- attract tenants;

- manage performance;

- meets ESG goals; and

- cost effective.

Health benefits:

- happier occupants;

- healthier spaces with cleaner air;

- indoor environmental quality;

- reduce pollution;

- reduce energy and carbon emissions; and

- it is worth noting that LEED certification dominates BREEAM certification in markets globally, except for in Britain.

From Hooke and MacDonald’s experience of managing over 3,000 apartments and houses for institutional investors there is an increasing focus on being able to monitor and report on sustainability and ESG performance over the life of the assets. The GRESB approach is being sought after by a number of investors at this stage.

Sustainability and the Irish market

The Irish development community has evolved very positively in terms of sustainable development and the newer buildings being produced are of a very high quality, with a strong focus on energy efficiency and promoting sustainable usage of utilities. This approach is from developers and also their architects and other design team members, who are very focused on sustainable development, and they are ensuring that these traits are being designed into new schemes.

Purchasers of houses and apartments in Ireland, are becoming more cognisant of the sustainable characteristics and energy efficiency. Buyers’ perception of sustainability has rapidly moved away from just the cost saving on their heating but towards the overall quality of their living environment. This can be seen across all consumer groups, with first time buyers who are generally younger, reviewing the savings they will achieve over the course of their mortgage based on a more sustainable build, while in comparison the older population may factor in the health benefits such as the air quality aiding the reduction of respiratory conditions which can be caused by dampness in older homes.

The future

The demand for efficient buildings is growing exponentially. With financial, environmental, and social incentives in place the built environment will continue to transform. The following trends are being seen in some markets:

- investor shift towards energy efficiency and emissions regulation accelerating;

- margin discounts offered by active green lenders accretive to overall fund performance;

- green buildings being able to exhibit lower systematic risk through more stable income; and

- potential for yield compression and increased asset liquidity.

Material sustainability issues are becoming increasingly relevant in the future in terms of capital values and liquidity. When buying a property today that is designed, delivered, operated, and monitored to the highest standards then you can have confidence that if you ever go to sell that property or have it valued you will be in a good position; and it will perform better than a property that does not have sustainable characteristics as an intrinsic part of its nature.

Dealing with purchasers, including investors, over recent months and from research internationally, Hooke and MacDonald have found that there is an increasing appetite for properties that can illustrate sustainability and ESG as a high priority. The Irish construction industry is very well positioned in terms of developing sustainable buildings and having a focus on energy efficiency and is actively embracing the concept.

T: 086 256 3851

E: ken@hmd.ie

W: www.hmd.ie