SSE Airtricity retrofit upgrades improving homes and benefitting communities

31st October 2023

Affordable Housing Act 2021: Housing support schemes

31st October 2023Stagnant wages and inequality perpetuating housing crisis

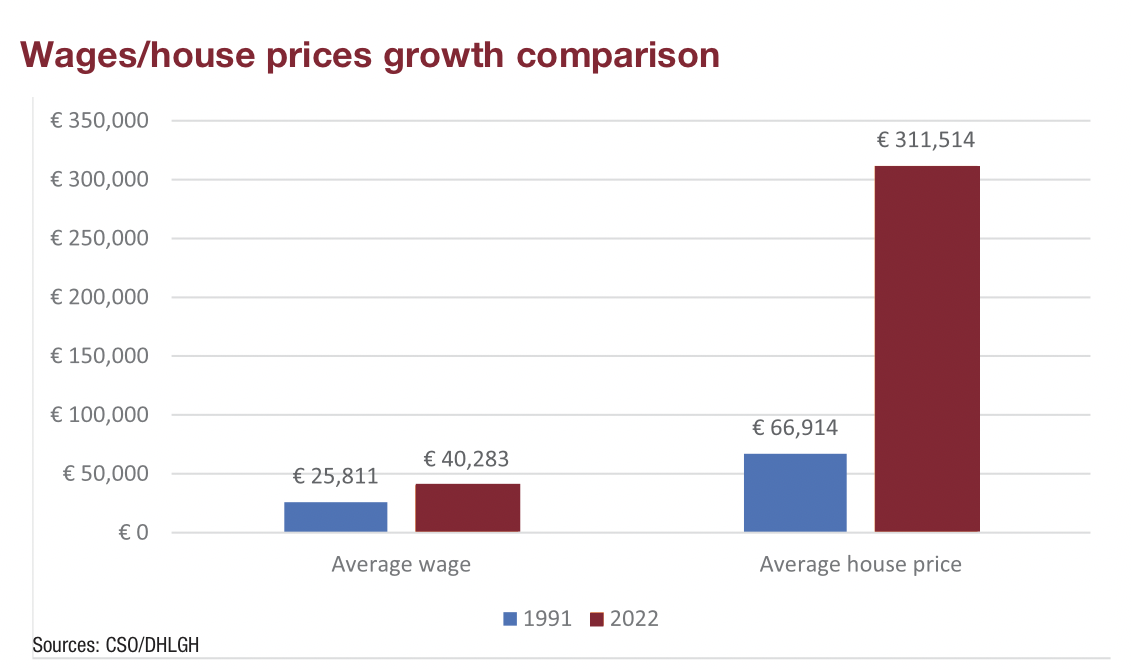

Census 2022 housing figures demonstrate how relatively stagnant wages in Ireland are exacerbating the inaccessibility of homeownership for young people in Ireland, with house prices increasing at a rate far above wage growth in real terms.

In July 2023, the CSO released the results of phase two of Census 2022, which shows that the rate of homeownership has continued to decline in the State, a trend which has been consistent in every census since 1991.

At the time Housing for All was launched in September 2021, Minister for Housing, Local Government and Heritage Darragh O’Brien TD stated that the strategy “puts forward a new vision that places homeownership back in the hands of ordinary working people”.

Census 2022 shows that that Ireland’s rate of homeownership stands at 66 per cent, a slight decline from the figure of 68 per cent in 2016.

Although Minister O’Brien has stated that the trend of declining homeownership is “starting to reverse”, Census 2022 figures outline a significant decline in homeownership from 1991, when the rate was recorded at 79.3 per cent. Furthermore, in all of the recent censuses (1991, 2002, 2006, 2011, 2016, and 2022), the rate of homeownership has declined compared to the rate recorded in the prior census.

Another long-term trend recorded by the Census is the age at which the Irish population become homeowners. In 1991, the average age at which Irish people became homeowners was 26 years old, however, the Census 2022 figures show that this has increased to an average age of 36 years old. Census 2022 also shows a significant increase between 1991 and 2022 in the age at which two-thirds of homeowners owned their own houses, with the average age having increase from 28 years old in 1991 to an average age of 44 years in 2022.

In an Ireland in which, according to Oxfam, two individuals have more wealth – €15 billion – than the poorest 50 per cent of the population, it is notable that whilst wages in real terms have increased 56 per cent between 1991 and 2022, house prices have increased at a rate of 466 per cent, exemplifying the new challenges facing the 2022 would-be Irish homeowner.

Whilst the number of people acquiring their first mortgage is in a seemingly perpetual decline, Census figures conversely show that the number of dwellings owned without a mortgage or loan was up 11 per cent between 2016 and 2022 to nearly 680,000, with the overall rate of mortgages declining in some regions of the State.

Every county in the State recorded a rise in the number of dwellings owned outright between 2016 and 2022. The number of dwellings owned with a mortgage or loan decreased by 1 per cent to 531,207. The largest falls in mortgaged properties were in Donegal (down 10 per cent) and Tipperary (down 8 per cent), where housing growth was slowest. There was an increase in the number of mortgaged properties in some counties, particularly in counties within commuting distance of Dublin where housing growth was strong, such as in Meath (up 9 per cent) and Kildare (up 6 per cent).

Ever increasing landlord influence

Speaking with eolas Magazine in June 2023, Minister O’Brien rationalised his government’s lifting of the winter eviction ban as being motivated by a desire to prevent “a mass exodus of good landlords out of the market”.

However, Census 2022 has reported that, contrary to the Minister’s apparent worries about a decrease in the size of the private rented market, more than 330,000 homes are rented from a private landlord, which is an increase of 7 per cent from Census 2016.

There was also a significant increase in the number households with people aged 65 and over renting from a private landlord to almost 17,000 households, up by 83 per cent since 2016. For households headed by a person aged 60 to 64 years, this was up by 69 per cent.

Nationally, more than 52,000 households were paying €400 or more per week in rent to private landlords in April 2022, compared with just 13,232 households in 2016. In Dublin city, the number of households paying €400 or more per week in rent was almost 23,000, up from 6,775 in 2016

Furthermore, the average weekly rent paid to private landlords continues to increase. In 2011 it was €171, rising to €200 in 2016, and to €273 in Census 2022. Between 2011 and 2022, this equates to a 59 per cent increase over the period, and a 37 per cent increase between 2016 and 2022.

Whilst government aims to implement measures such as increasing supply, and Census 2022 shows that the number of houses being built is increasing, the disparity between wages, wealth inequality, and house prices demonstrates the influence of an inflated private housing market which lacks the impetus of a state to act as a check on rising prices. Therefore, until the trend of disparity between house prices and wages starts to reverse, it is likely that homeownership will become an increasingly distant prospect for a new generation of Irish people.