Housing supply targets ‘understate need’

19th February 2024

Build 2024: What to expect

19th February 2024Hard and soft price increases driving construction cost uptick

The average cost of delivering a three-bedroom semi-detached house in a multi-unit scheme ranges from €354,000 to €461,000 dependent upon location. The majority of this cost is made up of hard costs such as construction materials, which cumulatively increased by 0.3 per cent in 2023.

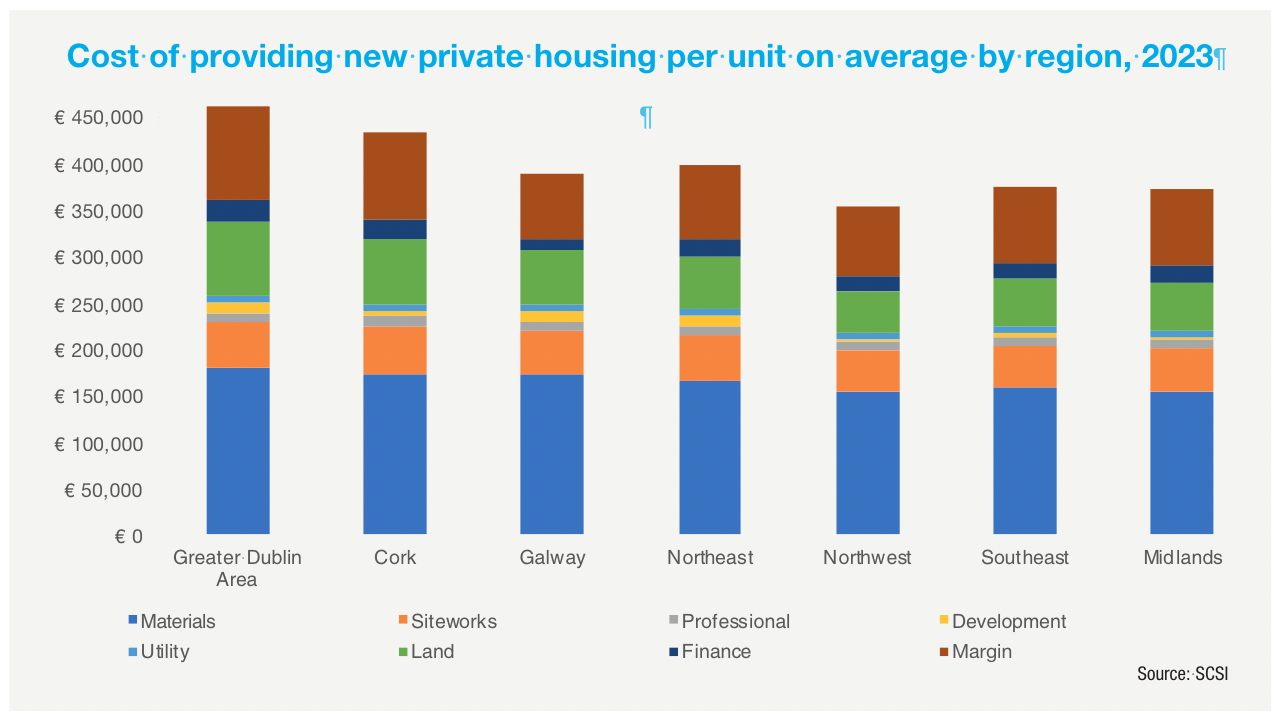

Research collating the covering seven regions by the Society of Chartered Surveyors Ireland (SCSI), published in December 2023, found that the cost of delivering a three-bedroom semi-detached house in a multi-unit scheme ranges from €354,000 in the northwest region (counties Mayo, Roscommon, and Leitrim) to €461,437 in the Greater Dublin Area (counties Dublin, Kildare, Meath, and Wicklow). This maximum price in the GDA represents a 24 per cent increase since 2020, when similar SCSI data found the average to bring such a house to market was €371,111, meaning that the average price to build a house in the cheapest region of the State in 2023 is now 95.4 per cent of the most expensive region’s average price in 2020.

The findings mean that the minimum annual household salary required to purchase a new three-bed semi-detached house in the GDA is €126,555 when government schemes such as Help to Buy and the First Home Scheme are excluded and the loan to income (LTI) ratio is 3.3. The corresponding figure for the northwest is €84,545, with other figures reaching as high as €114,545 in Galway and as low as €86,881 in the midlands region, defined as counties Tipperary, Westmeath, and Offaly. The most recent of the Central Statistics Office’s (CSO) Survey on Income and Living Conditions, published in February 2023, found that the median nominal disposable income for households was €46,999 per annum.

Hard costs – such as materials, housebuilding costs, and labour – comprise 53 per cent of overall delivery costs, with the remaining 47 per cent comprised of soft costs such as land prices, margin levies, financing costs, and VAT. Hard costs ranged from an average of over €198,000 per house in the northwest to over €227,000 in the GDA, a 15 per cent differential; soft costs ranged from €156,000 in the northwest to over €233,000 in the GDA.

While hard costs outweigh the soft costs overall throughout the State, this balance is flipped in the GDA, where soft costs account for 51 per cent of costs and hard costs for the remaining 49 per cent.

The significant increase in the average price of building a home in the GDA is attributed by the SCSI to increases in both hard and soft costs, which increased by an average of 27 per cent (€49,000) and 21 per cent (€41,000) respectively. Land and acquisition costs are said to average at 13 per cent of overall delivery costs per unit across the State.

Land and development costs average €78,962 per unit in the GDA and fall as low as €44,543 per unit in the northwest, with the proportion of the overall cost land and development costs account for 17 per cent in the GDA to 13 per cent in the northwest.

Material costs

The SCSI states that increases in hard costs are driven by increases in energy, fuel, and building materials price inflation. The Banking and Payments Federation Ireland, in its Housing Market Monitor Q3 2023, states that Irish construction costs increased by almost 23 per cent from the end of 2019 to the third quarter of 2023, having increased by just 9 per cent between 2015 and 2019.

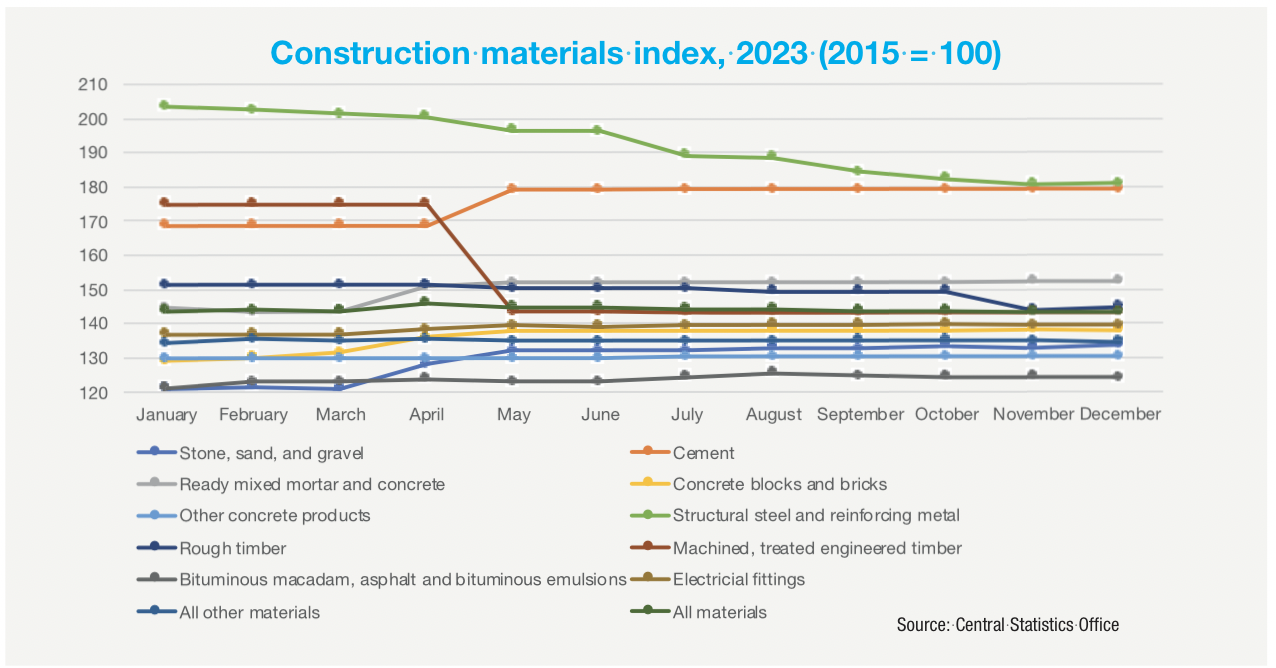

The CSO’s wholesale price indices for building and construction materials reflects these findings, with materials key to the construction of new homes seeing significant increases during 2023. The December 2023 indices show cement prices to have increased by 6.2 per cent on annual basis; stone, sand, and gravel prices to have increased by 8.4 per cent; ready mixed mortar and concrete prices to have increased by 7.1 per cent; concrete block and bricks prices to have increased by 6.5 per cent; and plaster prices to have increased by 7.3 per cent.

When annual averages for 2022 and 2023 are compared, these price increases can appear starker again, with the annual average for plaster in 2023 showing an increase of 24.2 per cent from the 2022 average, cement showing a 16.8 per cent increase, and structural steel fabricated metal showing a 24.8 per cent increase.

Some relief will be found in the dropping of timber prices, both rough and machined, with rough timber prices falling by 6.3 per cent on an annual basis and machined timber prices falling by 18.1 per cent. Rough timber’s 2023 average price showed a 15.2 per cent decrease from its 2022 average price, while machined timber’s average price fell by 8 per cent in 2023.

Decreases such as these and that of ‘other’ structural steel and reinforcing metal (down 23.4 per cent and 27.1 per cent on an annual basis respectively) balance out the overall indices, meaning that all materials cumulatively saw their prices increase by just 0.3 per cent on an annual basis.

In its capital goods price indices, the CSO records the building and construction price (i.e. materials and wages combined) as having increased by 2.7 per cent on an annual basis in December 2023. The average building and construction price in 2023 was 5.2 per cent higher than the 2022 average, making house prices unlikely to decrease in the short term while the cost of constructing them continues to increase.