Elderly homes scheme moves ahead following pilot success

30th October 2023

MMC: An introductory guide

31st October 2023First-time buyers are main purchasers of new homes

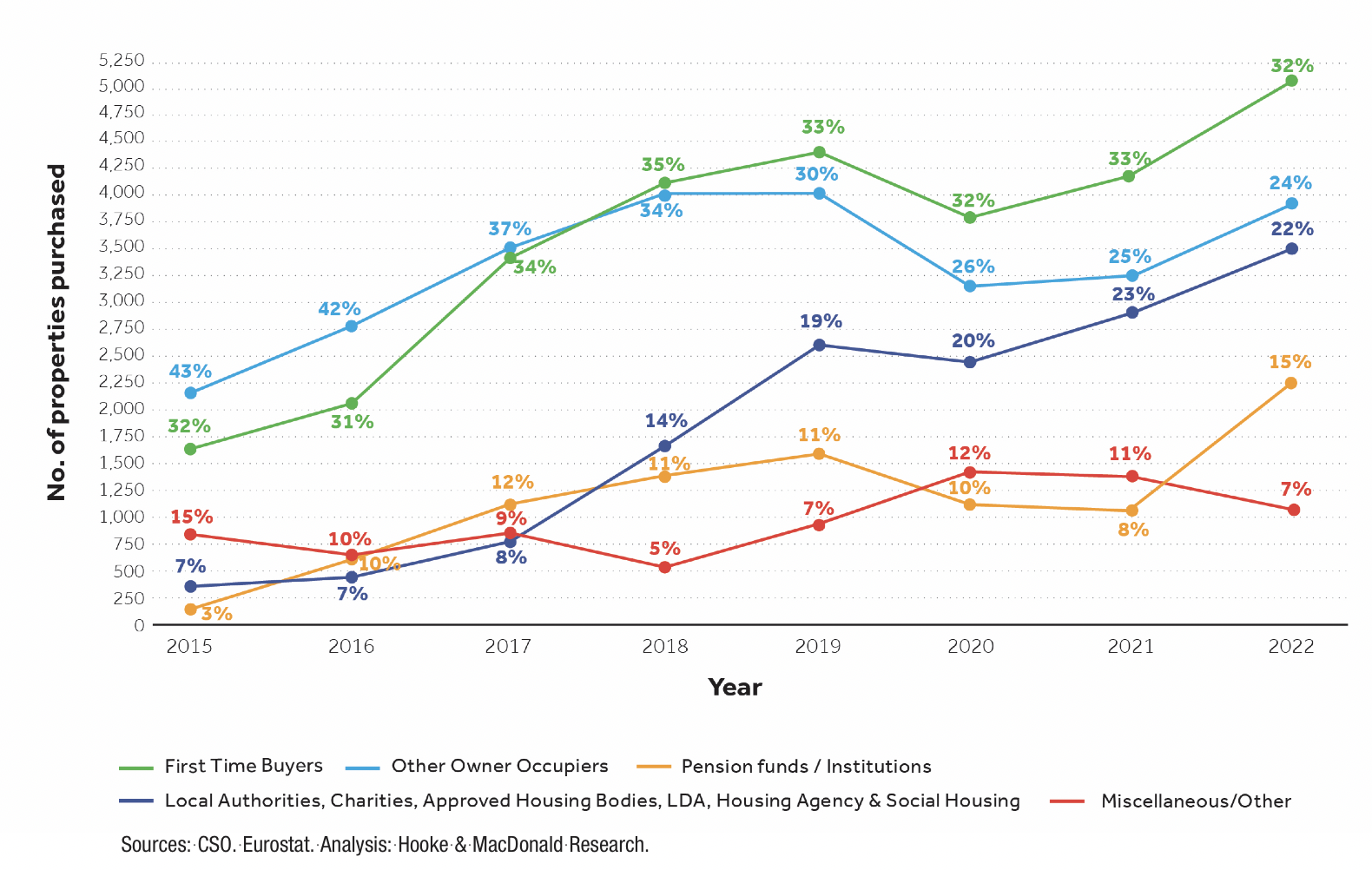

Hooke & MacDonald research has tracked the composition of purchasers of new homes in Ireland from 2015 to 2022. First-time buyers have consistently been the lead purchasing group, averaging 32 per cent of all purchases in the last three years, writes Ken MacDonald, Managing Director of Hooke & MacDonald.

First-time buyers are followed by other owner occupiers who averaged 25 per cent; next came social housing at 22 per cent with purchases by local authorities, charities, approved housing bodies, The Housing Agency and the LDA. The increasing level of purchases of new houses by AHBs and the LDA for social housing occupiers, while necessary, is inevitably going to lead to a decrease in supply available to first-time buyers and other owner occupiers.

Purchases by pension funds and institutional investors averaged 11 per cent of total purchases over the past three years – which is much lower than the public perception and misinformed narrative of the extent and importance of such purchases in boosting the supply of rental accommodation. The State can only fund a limited proportion of the €20 billion annual funding required in support of new homes supply, so it is imperative that the conditions are created for pension funds and institutional investors to make up the difference in funding requirements.

The Hooke & MacDonald research is based on CSO and Eurostat data relating to executed contracts, i.e., sale closures, so the increased activity of forward purchases by public sector bodies evident in the latter half of 2022 and into 2023 will only be reflected in sale closure executions in 2024 and 2025 when taking into account the time lag between contracting to buy and sale closures after completion of construction. Conversely, the reduced level of forward purchases by pension funds and institutions will also become evident two years hence.

€12 billion shortfall in funding

The reduced involvement of the private sector in funding the housing delivery programme is very bad news for bringing stability to the dysfunctional rental market and the plight of tenants seeking good quality modern accommodation. It is estimated that approximately €20 billion of funding per year is required to deliver the higher housing requirement figures which the Housing Commission recently published, between 50,000-62,000 per year. If the Government increase their funding from €4 billion to €8 billion annually this still leaves a shortfall of €12 billion. The only parties that can bridge this gap are longer-term international funders and investors.

Some politicians have said that the shortfall could be bridged by credit unions and the European Investment Bank (EIB). The credit unions have a total of €3 billion in funds and they would only ever be allowed by the regulator to lend a fraction of this and when it is gone, it is gone, whereas the funding requirement is for every year for many years to come. Similarly, the involvement of the EIB is not practical as if they were to lend €12 billion annually, it would have to go on the State balance sheet, and this is not a viable long-term option. In any case the interest rate that the EIB would charge would not differ much from what the institutional investor/pension funds will charge.

The reality is that institutional investors/pension funds have been responsible for funding over 15,000 apartments in Ireland in the past six years. If these had not been built, the rental market would now be in a far worse position than it currently is.

The sharp slowdown in apartment construction in Dublin and other cities is a direct result of the lack of viability due to rising interest rates and construction cost inflation and the disconnect between what end users can afford to pay for apartments and what they need to be sold for to make an economic return. Other countries, such as the US, have dealt with this by tax incentives and subsidisation of higher density apartment development in urban areas.

The Irish Government are gradually introducing measures to enable apartment delivery to be increased but these are only impacting the owner occupier market and much more radical measures are needed, including measures that foster development for the rental market. The funding of the subsidies needs to be front loaded to enable development to commence rather than attempting to have payment made when projects are completed, which is not feasible for developers.

Composition of purchases of new homes in Ireland 2015-2022

Construction costs have increased to unprecedented levels over the last four years. Also, as highlighted by the Society of Chartered Surveyors Ireland in their July 2022 Construction Tender Price Index report, the construction industry is reportedly “near peak capacity”, and as a result, increasing new supply further will be a challenge. It is not surprising that apartment commencements are not matching consents.

The most recent cycle for apartment construction started in circa 2016 and while many parties with land have sought to improve the developability of the land by securing a planning consent over the last four or five years, unlike in the 1990s and early 2000s when funding and purchasers were freely available and commencements followed planning consents, most of these new planning permissions will not be built as a result of the lack of funding and viability.

The funding and development model for apartments in Ireland is broken and has been for a number of years. It has only been through the development for the private rental sector that most apartments have been built. As a result of the new development environment (higher finance and construction costs) this avenue for delivery is now very limited. While many parties see this as an opportunity for the State to step in and boost supply in terms of social and affordable housing, the country also needs a substantial level of new properties for private rental and sale.

Hooke & MacDonald

118 Baggot Street Lower

Dublin 2

PSRA No. 001651

T: 086 256 3851

E: ken@hmd.ie

W: www.hmd.ie