Affordable Housing Act 2021: Housing support schemes

31st October 2023

Delivering affordable homes

31st October 2023Housing supports shifting the affordability crisis

Affordability in the Irish housing market is not out of sync with European counterparts, but the country does have one of the largest gaps in homeownership rates between younger and older generations.

Worsening affordability pressures and falling homeownership rates are distinct challenges, but not wholly unique, according to research carried out by the ESRI.

The finding that Ireland’s renters have the lowest rent-to-income ratio of 15 European countries analysed is surprising in the midst of the country’s affordability crisis, however, the finding is not fully reflective of how individual cohorts are faring in comparison to their counterparts.

For example, while Ireland has one of the highest rates of homeownership for households aged 40 and above (79 per cent), it is ranked 10th (34 per cent) in the highest rate of homeownership for households aged below 40, creating one of the largest gaps in ownership rates between younger and older generations.

Similarly, figures around homeownership are somewhat distorted. Around 54 per cent of households in the lowest income quintile own their home outright, driven by Ireland’s high rates of outright ownership for retirees (over 65s).

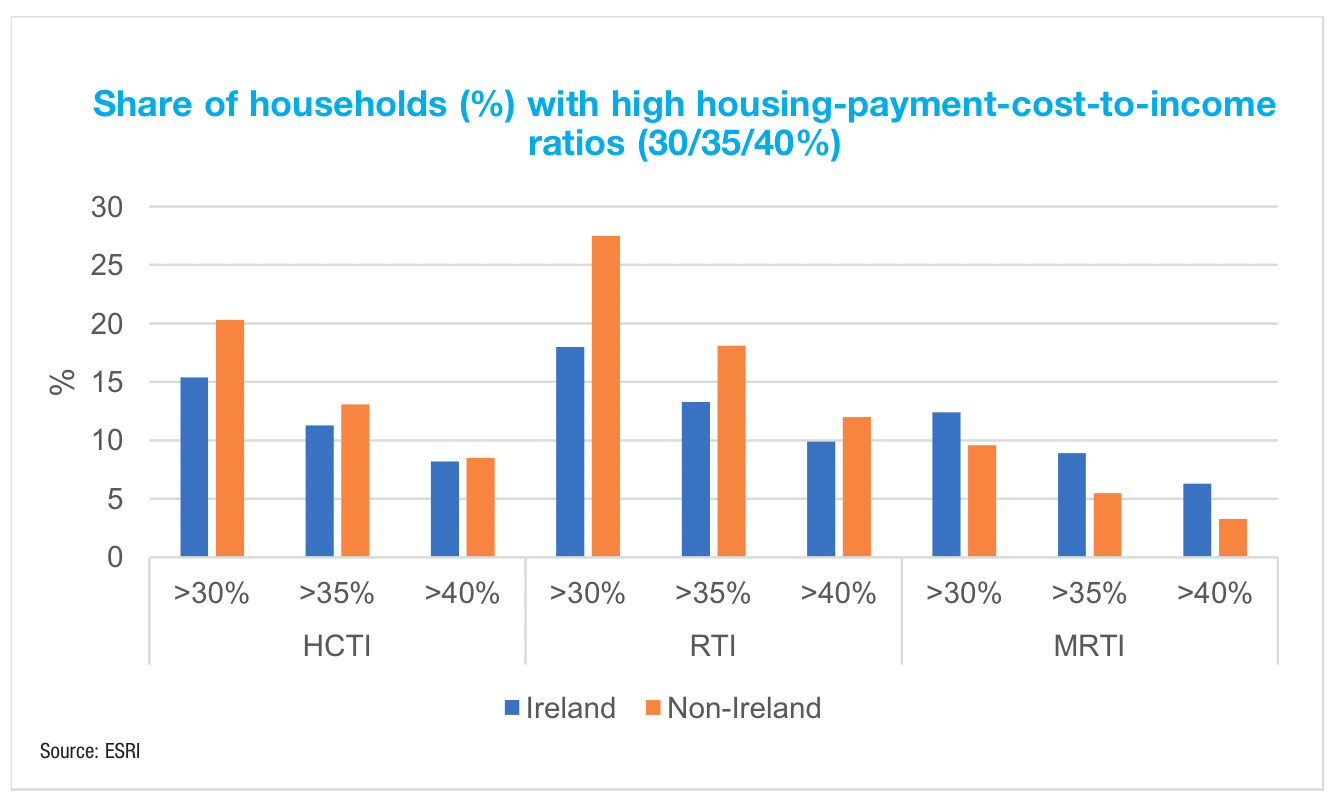

Housing affordability: Ireland in a cross-country context aims to better contextualise the housing affordability challenges faced in Ireland by examining how key affordability indicators such as housing-payment cost-to-income ratios for Irish households (across tenures, incomes, household composition, urbanisation, and age) compare with 14 other European countries.

The research paper highlights alterations to affordability in recent years, driven by a number of factors, not least government policy supports, such as the expansion of the Housing Assistance Payment (HAP). For example, 58 per cent of households had insufficient residual income after housing costs to meet minimum living costs in the market price private rental sector in 2017, but by 2019, this proportion had fallen to one-in-three households.

On average, Irish households pay around one-fifth of their net incomes on their housing payment costs, with only five countries displaying better average housing affordability (Norway, Denmark, Portugal, Austria, and Sweden).

Renters pay on average 20 per cent of their net income on rent, giving Ireland the lowest rent-to-income ratios (RTI) among the 15 countries analysed. The impact of government support can be seen by the fact that while on average Irish renters have better affordability relative to other countries analysed, renters in the fourth and fifth income quintiles face rent-to-income ratios that are on average two to three percentage points higher than their European peers. Essentially, HAP supports those of lowest incomes, the affordability challenge mainly falls on those of lower-middle income.

This is highlighted by the finding that since 2014, the share of renters in the bottom 25 per cent of the income distribution not in receipt of any form of long-term housing supports fell from over 45 per cent to 25 per cent. In the second quartile of the income distribution, this share also fell markedly from 2017 to 2019 by nearly 20 percentage points.

A further finding in the research is that Irish households have more dispersed rent-to-income ratios than their European counterpart, meaning some households face more extreme affordability burdens, and others less, in comparison. This is highlighted by the fact that in the third and fourth income quintile, where more than half of private renters not in receipt of housing supports are located, the largest share of households pay more than 30 per cent of their incomes on rental costs.

While the rent-to-income ratio appears on average to be lower in Ireland compared to elsewhere in Europe, Irish renters have a larger urban/non-urban divide than their counterparts. Ireland’s 5.5 percentage point gap is significantly larger than the 2 per cent gap evident across Europe. However, this gap is not as significant in relation to mortgage holders.

While most of Europe has followed a trend whereby rising affordability pressures have been primarily concentrated amongst the lowest income rental households, supports in Ireland have somewhat mitigated the effects for these households. However, while these supports have removed many lower income households from the market price rental sector, the affordability pressure challenge has not been resolved, but simply shifted. One-in-three rental households who do not receive state housing supports pay more than 30 per cent of their net income on rent, compared to 7 per cent of mortgaged households.