Rent Pressure Zones to be replaced

1st June 2021

Numbeo comparison: Irish property prices

1st June 2021Investment in long-term social leasing is part of the solution to Ireland’s housing problem

There has been much focus in recent months on the concept of local authorities and approved housing bodies (AHBs) leasing residential accommodation on a long-term basis in an effort to help to reduce housing lists throughout Ireland, writes Shane Cahir, Director, Residential Capital Markets, CBRE Ireland.

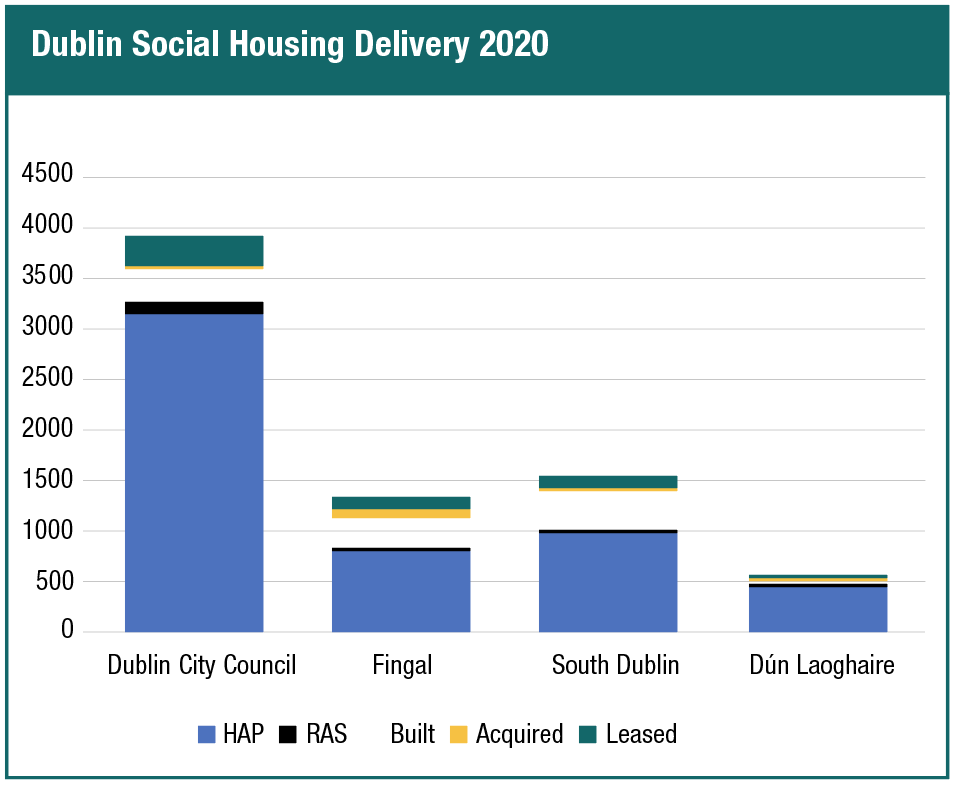

It must be stressed that long-term leasing is and should only ever be ‘part of’ a solution to delivering public sector housing, with the preference obviously being on the development of new stock and acquisition of housing through mechanisms such as Part V legislation. However, considering the sheer extent of the public sector housing need, with more than 61,880 households waiting to be housed, the fact that construction has been severely curtailed in the last 12 months due to lockdown and the fact that housing units are needed sooner rather than later and there is no time to be wasted with bureaucracy and procurement etc, there is certainly scope for more long-term leasing to help to address the severe shortage of public sector housing in the short to medium term. It can be seen that leasing is just part of the solution currently being pursued, with Housing Assistance Payment (HAP) being the most prevalent.

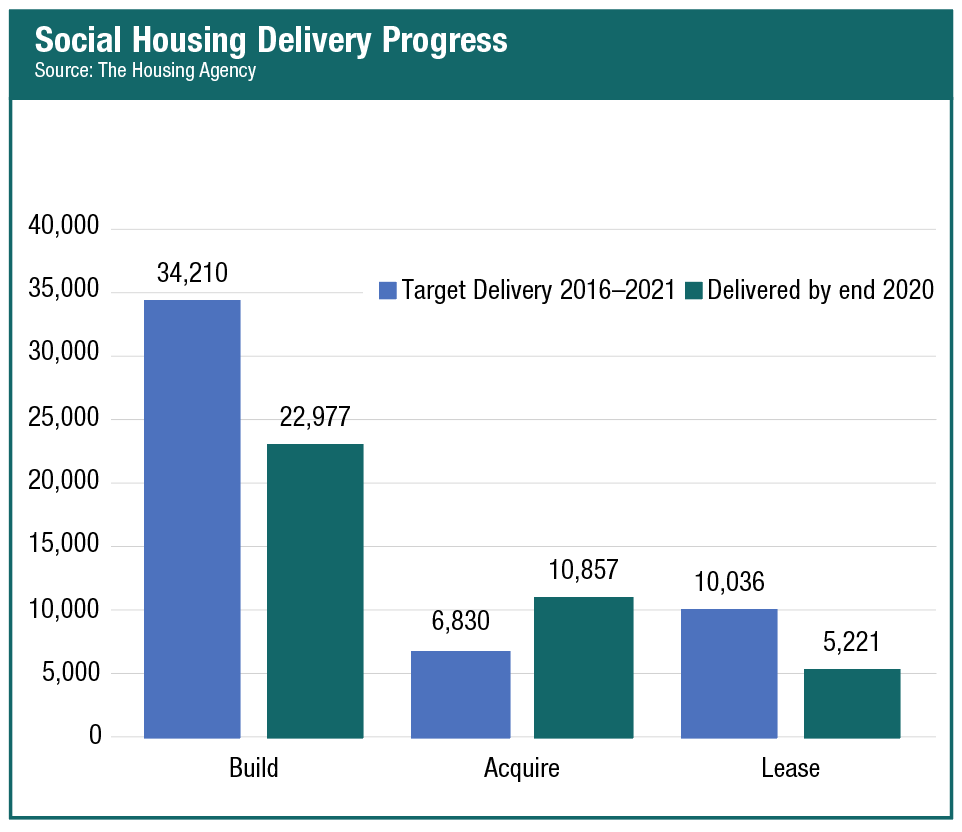

Recent research from The Housing Agency suggests that only 52 per cent of the volume of long-term leasing envisaged in the Government’s Rebuilding Ireland plan for the period 2016–2021 had been achieved by the end of 2020. Of the 10,036 units targeted to be achieved through long-term leasing specifically, only 5,221 were delivered by year-end 2020. The reality is that unlike the target of public sector housing units to be built in the period, which is now clearly looking unattainable, the target of 10,036 long-term leasing units could potentially still be achieved if local authorities throughout the country embraced this concept and were open to leasing units on a long-term basis.

Over the last two years, we have witnessed strong demand from investors, both Irish and international, to acquire housing that has been leased long-term, which in turn is helping to ensure deliverability of much-needed new stock. While initially this took the form of leases on individual houses and apartments, more recently, we have seen long-term leasing on blocks of units. We should be embracing this investment on the basis that it is facilitating the delivery of quality residential accommodation for local authorities that might not otherwise be developed, to help them to tackle their high housing lists.

CBRE Ireland have been instrumental in some of the most notable transactions in this space in the last two years including the acquisition last year by the German fund Real IS of 87 units leased to Dún Laoghaire-Rathdown County Council in the Herbert Hill scheme in Dundrum in south Dublin. In recent months, we were involved in the sale of the Marina Village development in Greystones, County Wicklow and recently agreed the investment sale of a block of more than 60 new build apartments in South Dublin, which will be let on a 25-year lease to the local authority. We will shortly be launching the sale of a portfolio of 55 socially leased houses and apartments to the market, a transaction with a lot size of approximately €21 million which we expect will be competitively bid.

Our expertise in this very specialist investment sector is copperfastened by best-in-class expertise from our CBRE colleagues in other jurisdictions where long-term leasing is well established. Investor demand for long-term residential investments is in line with trends elsewhere in Europe and the UK where the investment market for public housing is well established and institutional capital, pension funds, private equity investors and other specialist investors regularly invest in public housing provision.

Until recently, there was no standard leasing mechanism in place to facilitate this form of investment in the Irish market with a combination of approaches being adopted including the Standard Lease (which was the structure commonly used for leasing individual property assets historically) and more recently the Enhanced Lease (a structure specifically designed for block leasing), which was adopted in the Dundrum transaction mentioned above. More recently, a more institutionally acceptable standard lease for entire developments has been developed, opening up this investment option to new investors. The mechanism is therefore now in place to facilitate more long-term leasing in the Irish market, and we should capitalise on the volume of capital looking to deploy into this sector considering the extent to which it can help local authorities to reduce their housing lists. Some investors will be willing to consider a pepper-pot approach (building a portfolio by acquiring individual mainly second-hand housing units over time) while most investors will specifically look to acquire or forward commit to blocks of modern purpose-built residential stock, which they will in turn lease in part or in full on a long-term basis to an approved housing body or the local authority. Some will have a preference for leasing directly to the local authority as opposed to an AHB.

Of the 61,880 households in need of housing when the Housing Agency research was last conducted at the end of 2020, 43 per cent of households qualifying for social housing and waiting to be housed were located in the Dublin region with 53 per cent of these located in the Dublin City Council local authority area specifically.

This is not just a Dublin problem, however. Demand for local authority housing is also high throughout the country with particular demand in Cork City and Cork County, Kildare, Kerry and Limerick. Long-term leasing is a solution that can be pursued everywhere in the country so we would encourage all local authorities to consider it as a potential solution. Although it is clear that there are significant public housing shortages throughout the country, international investors are likely to seek a Dublin weighting and are likely to focus on cities before considering investing in other locations. Domestic investors are more likely to adopt a national approach.

27 per cent of all households on the housing list in 2020 have been waiting an average of seven years to be housed, illustrating the extent of undersupply of public housing provision in Ireland in recent years and the need to increase delivery at this juncture. Long-term leasing is one part of an overall solution to this and CBRE Ireland will be delighted to talk to anyone seeking to learn more about this emerging sector. It is clear that collaboration between the private and public sector has a significant part to play in increasing delivery of much-needed public housing and that private sector investment in public housing will assist government in their aspiration to deliver 50,000 social houses over the lifetime of the current administration.

T: 01 618 5500

E: shane.cahir@cbre.com

W: www.cbre.ie