Report of The Housing Commission and the next housing plan

30th June 2025

The key to meeting housing demand

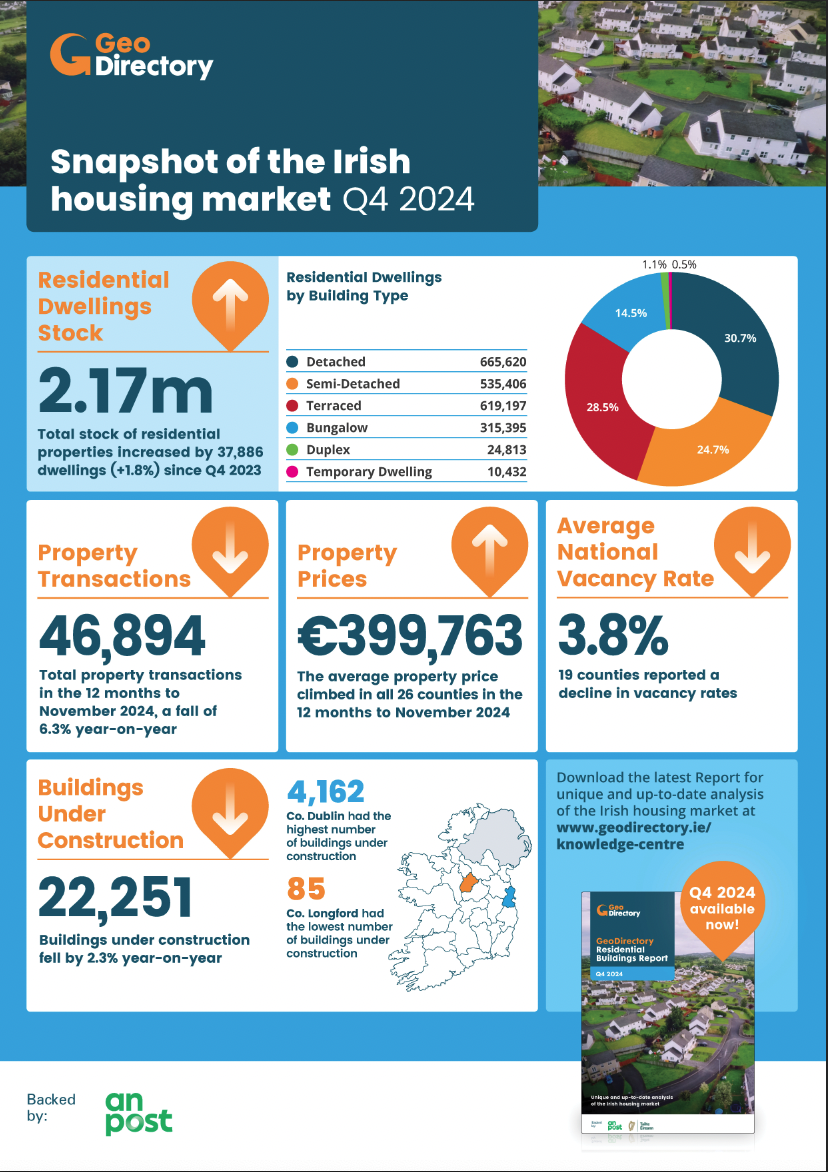

30th June 2025Key trends in Ireland’s residential property market in 2024

Ireland’s housing market in 2024 demonstrated both progress and persistent structural challenges, offering critical insights for shaping housing strategy in both the private and public sector.

A total of 34,686 new residential address points were added to the national stock in 2024, marking a 20.7 per cent year-on-year increase. This growth was concentrated in the Greater Dublin Area, which accounted for over half of all new addresses, with Dublin alone contributing 38.1 per cent. While this reflects a positive trajectory in housing delivery, it still represents just 1.6 per cent of the total housing stock, underscoring the need for sustained growth.

Construction and vacancy trends

Despite a strong pipeline of 60,243 housing commencements (+83.7 per cent YoY), the number of buildings under construction declined by 2.3 per cent, and completions fell by 6.7 per cent. This lag between planning and delivery, highlights the well documented need for streamlined planning processes, capacity-building in the construction sector and the expansion of serviced land.

Vacancy rates declined marginally to 3.8 per cent nationally, with Dublin at a low of 1.2 per cent. However, 80,689 dwellings remain vacant or derelict, these figures point to an opportunity for adaptive reuse and refurbishment.

Affordability and market pressures

The average national house price rose in 2024 to €399,763, up 7.2 per cent year-on-year. Prices increased in all 26 counties, with the sharpest rises in Sligo, Westmeath, and Limerick. Meanwhile, rents reached an average of €1,955 per month, outpacing wage growth in many areas.

Affordability remains a critical concern. While it is cheaper to buy than rent in many counties – particularly for existing dwellings – first-time buyers face income gaps in 30 of 31 local authorities.

Implications

To address these challenges the solutions are well known and can be summarised in the following headings

- scaling up refurbishment incentives (e.g., Vacant Property Refurbishment Grant, Urban Regeneration Fund);

- accelerating planning approvals and infrastructure delivery;

- expanding affordable housing and first-time buyer supports; and

- leveraging data to target vacancy and dereliction hotspots.

The 2024 data underscore the need of a multi-pronged, regionally balanced housing strategy to meet Ireland’s growing and evolving housing needs.

The forthcoming GeoDirectory Residential Buildings Report 2025, set to be published in August, will provide updated insights into Ireland’s housing stock, vacancy trends, and regional supply dynamics.