The role of strategic housing development

1st August 2018

Replicating and scaling the Ó Cualann model

1st August 2018Private consortium approved for Mortgage to Rent

The introduction of private companies into the Mortgage to Rent (MtR) scheme has been met with mixed reaction.

Central Bank statistics from the first three months of 2018 show that there are nearly 30,000 long-term (over 720 days) residential mortgage arrears cases in Ireland and there are concerns that potential repossessions could deepen the current housing crisis.

In July, the Government launched a Mortgage to Rent information website alongside the announcement that a new private entity will become the first of its kind to offer the service.

The move comes after changes implemented by then-Housing Minister Simon Coveney, TD in 2017, following a review of the original Mortgage to Rent Scheme in 2012, which was largely deemed a failure. Information released by Fianna Fáil’s finance spokesperson Michael McGrath, TD revealed that over six years, just 282 mortgage-to-rent cases were completed out of a potential 3,766 (574 cases were still being progressed in January 2018).

The Government describes MtR as a scheme to help homeowners who are at risk of losing their homes due to mortgage arrears.

“It lets homeowners in mortgage difficulty switch from owning their home to renting their home as social housing tenants. The scheme is overseen by the Department of Housing, Planning and Local Government and is administered by the Housing Agency,” the new information site reads.

Adding: “The MTR scheme is a social housing option only available if you are eligible for social housing support and your mortgage is unsustainable.”

The key changes that came in to play after the review included:

• More households being eligible for the scheme in terms of both the suitability of the property size to the household, as well as the value of the property itself;

• A quicker, easier and more accessible process to households in mortgage distress, as well as the other participants, including the lenders, local authorities and Approved Housing Bodies (AHBs); an

• Better understanding of the scheme, with borrowers becoming more familiar with it and how they can access and benefit from it. A range of state agencies will be facilitated to assist and guide borrowers, who could benefit from the scheme.

Also included in the review was the understanding that the financial model of the scheme made it unlikely that it could deliver on the scale of ambition. The review stated that alternative funding options were now available, including the offbalance sheet potential of private institutional investment.

Prior to this, Approved Housing Bodies (registered charities), were the only groups eligible to offer MtR. However, in July the launch of Homes for Life marked the first instance of private investment in the scheme.

Initially, the consortium will serve Permanent TSB customers but it is in discussion with other financial institutions about the scheme. It is believed that the company is initially targeting 500 MtR solutions, an estimated investment of over €100 million.

The scheme requires those eligible to surrender ownership of their home to their mortgage lender. An AHB or private company then buys the property, and while the tenant no longer has any financial interest in it, they may continue to live there as a tenant of a local authority or AHB.

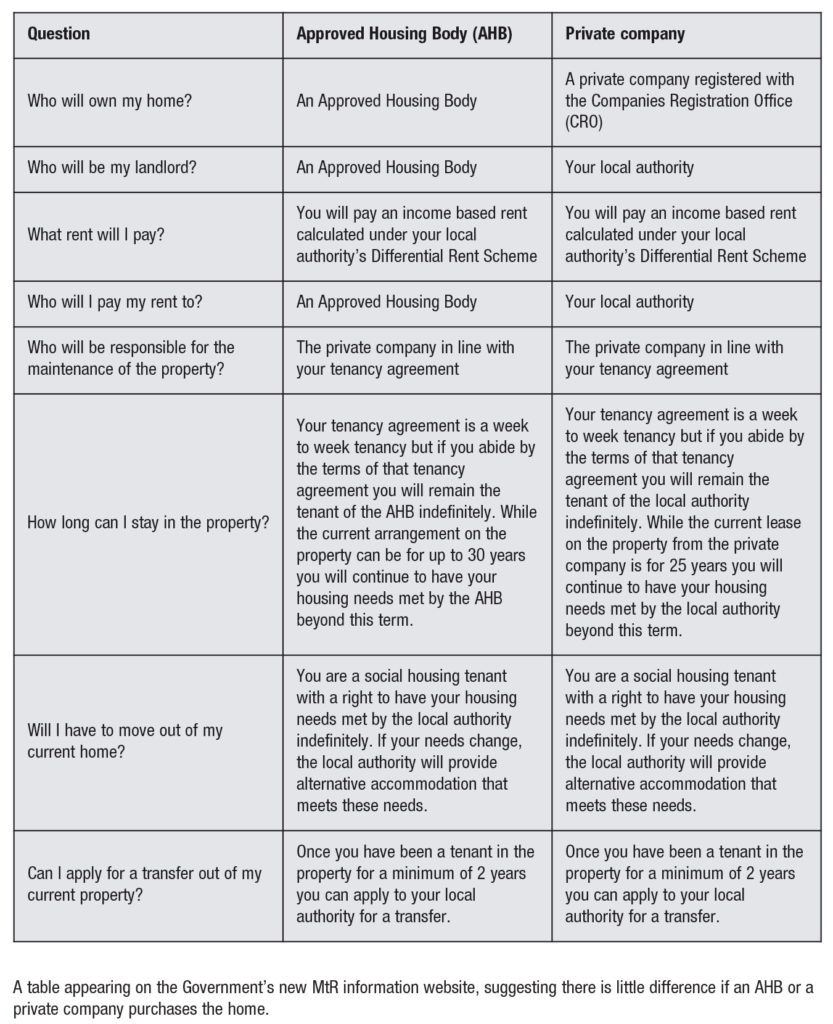

This is because, under an AHB, the charity becomes the landlord and the former owner becomes a social housing tenant. If a private company is involved, they will lease the property to a local council for 25 years. The former owner then becomes a social housing tenant of the council, with the company maintaining the property.

Private companies are approved by the Department of Housing, Planning and Local Government for the delivery of the MTR scheme and have been set up for this specific purpose and are registered with the Companies Registration Office. Former owners are also given the opportunity to buy back the property if their financial situation improves.

The Government has been keen to stress that for home owners entering the scheme, whether an AHB or private entity buys the property, it should make little difference to the outcome. However, there have already been some criticisms of private involvement.

Welcoming the appointment of Home For Life, Minister of State with Special Responsibility for Housing and Urban Development Damien English, TD, described it as a “significant step” towards a scaling of Mortgage to Rent to meet the needs of more borrowers in mortgage distress.

“It offers the flexibility of private funding with the trust and assurance that comes from having a local authority as a landlord,” he said.

However, critics have pointed to terms deemed overly generous for private investors, with a state-backed yield of 6 per cent for terms of over 20 years. Others have pointed out that previously, off-balance sheet mechanisms have often proven more expensive, with the cost ultimately paid by the taxpayer.

There has also been concerns raised over the contrast between charities and private investment firms operating the same service, with the main question being what guarantees exist for the tenant after the 25 year lease expires.