Tower block future: Post-Grenfell

10th July 2020

Affordable housing

10th July 2020Risk in the social housing sector

Brexit, the Office of National Statistics (ONS) classification and the introduction of Universal Credit were amongst some of the largest risks identified by registered housing associations (RHAs) as they entered 2020.

Compiled prior to the outbreak of Covid-19, the NI Registered Housing Associations Risk Profile 2019 highlights the pre-existing common risks in the social housing sector.

The Risk Profile includes reviews of RHA’s risk registers and consultation with stakeholders such as the Northern Ireland Housing Executive and the Department around identified risks.

Housing regulations state that housing providers must adopt a robust approach to the assessment and management of risk and demonstrate informed and transparent decision-making processes. The Department defines risk as “a chance of something happening that has an effect on the achievement of an organisation’s strategic objectives”. The effect can be both negative and positive, however, organisations should proactively manage risks by preparing for all outcomes.

The Risk Profile separates strategic risks into three broad categories of strategic risk, operational risk and financial risk.

Financial risk

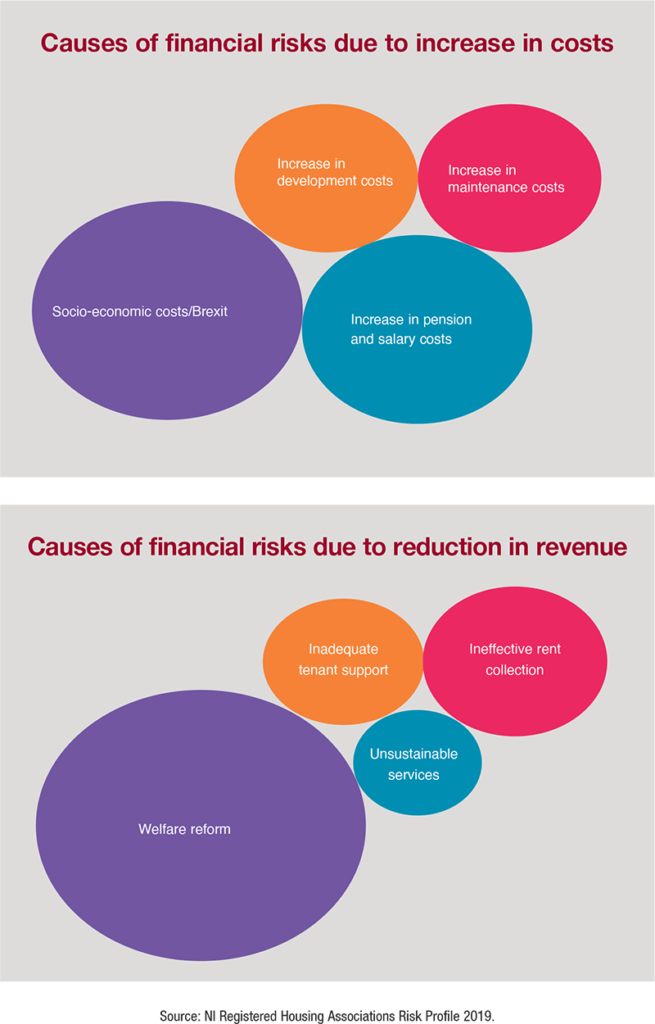

Increased costs have been identified as a financial risk to housing association’s operations and RHAs consider socio-economic factors such as the impact of Brexit to be the most likely source of cost increases. A key concern centres on the potential of cost pressures relating to access to labour, either for RHAs directly or for their development contractors.

Housing associations also recognised Brexit’s impact of devaluing sterling and therefore making the importation of goods and materials more expensive and ultimately increasing development and maintenance related costs. Additionally, the prospect of increased interest rates, making the servicing of loans more expensive was noted, as was inflationary pressures on things like pensions and staff related costs.

Another identified financial risk by RHAs was that relating to increased levels of arrears and voids leading to a reduction in revenues. In particular, welfare reform/Universal Credit was pinpointed as a potential cause, as was inadequate tenant support, ineffective rent collection procedures and unsustainable services.

In February, the then Minister for Communities, Deirdre Hargey, announced plans to extend some welfare mitigations, particularly the bedroom tax, beyond the initial end date of 31 March 2020. However, Universal Credit was introduced in Northern Ireland on a phased geographical basis in September 2019 and within the risk report some RHAs highlighted that they had already noticed increases in arrears as a result of the changes to benefits. The most prominent reason was that of “technical arrears” such as delays to tenants receiving housing benefit.

The report notes the potential for the number of risk arrears to rise as more tenants move to Universal Credit because of rules around limitations on backdating claims and the inability to facilitate costs for overlapping tenancies in most instances.

Housing associations had signalled concerns around the introduction of the bedroom tax, with mitigations expected to end by April 2020. While the Minister has now mitigated against the tax beyond that date, threat of future introduction still remains and RHAs believe that the tax could have an impact on the levels of voids, as some properties may become unsuitable for some groups of tenants.

Similar to an increase of costs, not surprisingly, financial loss was highlighted as a risk for RHAs. Reduced rental income was flagged as a concern and RHAs described a challenge in maintaining a balance between offering affordable rents but also ensuring adequate returns to service debts, provide services and maintain their housing stock. To this end, other funding streams are important, and any loss of government funding was identified as a major risk.

In particular, RHAs flagged Supporting People funding and the Housing Association Grant (HAG) as streams where, if levels were reduced, considerable financial strain would be created. A reduction of Supporting People funding would affect those providing supported housing in their ability to maintain services, while a reduction in HAG would require RHAs to secure more private borrowing to fund development plans and deliver services.

Operational risk

Although described as an operational risk, the financial implications associated with compliance in relation to information security, data protection and GDPR were major risks identified by RHAs. RHAs voiced their concerns around sensitive or financial information being destroyed, lost or stolen and the challenges avoiding this presents. Failure to comply with GDPR requirements brings threats of potential fines, the maximum of which are £20 million or 4 per cent of an organisation’s annual turnover, whichever is highest.

Listed amongst other operational risks are those relating to government targets for development and challenges around attaining appropriate land for development and planning process delays.

RHAs recognise the risk associated with being unable to assume continued financial support from the Department at current levels, given the levels of increased pressure on public spending. Long term-funding uncertainty is therefore a risk to RHAs, and this could have knock on effects in relation to the appetite for new build delivery and the ability to secure private finance.

To some extent, these risks are already being recognised. In 2018/19 the Social Housing Development Programme fell short of the 1,850 new social homes target with issues such as lack of land availability in areas of high social housing need, planning restrictions and capacity all being identified as key reasons for the shortfall.

Strategic risk

Delivered prior to the reformation of the Northern Ireland Executive and Assembly, a major risk outlined by RHAs was that of the ONS classification of 2016 which saw housing associations in Northern Ireland reclassified from the private to public sector and designated as Public Non-Financial Corporations.

The Executive has since moved to fast-track a Bill that would reverse the decision following a further derogation by HM Treasury to 2021. Until the relevant Bill achieves royal assent and the ONS subsequently agree to reverse the decision, concerns from housing associations that restrictions could come in to place on private borrowing for the development of new homes, remain in place.

Finally, reputational risks were another potential area outlined by RHAs. The most prominent of these risks defined by housing associations related to health and safety measures and the potential threat to an organisation’s reputation. The risk report suggests that a heightened level of awareness to this risk is perhaps fuelled by the greater levels of scrutiny by regulators and the public following the Grenfell Tower fire.

Additionally, and pertinent following the outbreak of Covid-19, housing associations recognised the threat to reputation of incidents in relation to the safeguarding of vulnerable residents. In particular, those RHAs providing care services to vulnerable residents rated the risk especially high in terms of the potential adverse impact on their reputation.

Undoubtedly, Covid-19’s societal and economic impact will now form a major part of housing associations in Northern Ireland’s thinking in relation to risk. Most notably the economic impact in relation to housing development but also on the government’s funding priorities and future budget allocations.