Tackling the homelessness challenge in Dublin

19th July 2017

Plan-led development is the future

19th July 2017Social housing funding models

Neil Collins, Director of KPMG Corporate Finance asserts that there is an urgent need for structures that will facilitate institutional investment demands to support the delivery of large-scale social housing market development in Ireland.

The Irish Government’s Action Plan for Housing and Homelessness: Rebuilding Ireland recognises that housing is a basic human and social requirement and states that the Government’s mission is to ensure that everyone can access a home, either on their own or with State support.

In particular, it recognises the need to address the dramatic undersupply of housing and the problems it generates for families and communities. Accelerating social housing was identified as one of the five pillars of action to address this key social issue, with a target of delivering 47,000 social housing units to 2021 with funding of €5.35 billion. In summary, it recognises the human, social and economic cost of failing to deliver a housing strategy that is fit for purpose.

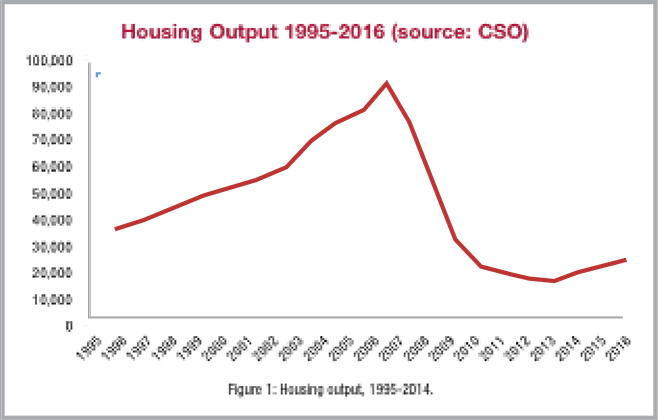

The scale of delivery required and the current challenges in the housing sector are significant. The latest National Statement of Housing Supply and Demand 2016 and Outlook for 2017-18 identified over 81,000 homes needed by 2020, 91,600 assessed households as qualified and in need of social housing support, over 7,000 people homeless, a growing affordability problem in cities and for renters and 50,000 mortgages in long-term arrears. It is recognised that no one funding or delivery model will deliver the required social housing stock within this timeframe. Therefore, a number of models are being utilised.

Local Authority direct provision: Local Authorities are directly providing housing to people on the social housing list. However, there has been limited delivery of new social housing at scale by Local Authorities in recent years when compared to historic volumes provided in this way.

AHB direct provision: Much of the social housing stock in Ireland is provided by Approved Housing Bodies, regulated by the Housing Agency and the Charities Regulator. While the Approved Housing Bodies have been adding to their stock (including through developments on sites provided by NAMA through the NARPs scheme or financed under the CALF and CAS schemes), the overall volumes being added and the scale of the Irish AHB sector is relatively modest compared to the overall need cited above.

Private sector participation: There are a number of ways in which private sector participation in the social housing market is being harnessed:

- a PPP programme which is planned to deliver c.1,500 units has recently commenced the first of three procurements. These projects are structured so that the private sector take design, build, finance and maintenance responsibilities in return for a regular Availability based payment from the relevant Local Authority over a 25 year operating period;

- Local Authority-led mixed tenure projects such as South Dublin County Council’s Kilcarberry project (892 units) and Dublin City Council’s Housing Land Initiative (O’Devaney Gardens, Oscar Traynor Road and St Michael’s Estate providing over 2,000 units). These projects envisage a partnership whereby the Local Authority supplies a site on which a developer will provide a mixture of social housing and units for private sale/rental; and

- private sector provision (10 per cent of units on a site) under Part Five of the Planning Acts.

While each of these delivery mechanisms are worthy in their own right, the collective pace of delivery is still lagging behind social housing needs. In conclusion, and in the context of the Minister Murphy’s upcoming review of Rebuilding Ireland, we believe that there is an urgent need for the public sector to bring forward structures that will allow large-scale social housing market development backed by institutional funders who will be attracted by the long-term, public sector-backed revenue available from the sector. We believe that similar structures could be used in the mortgage to rent space.

For more information please contact:

Neil Collins

Director, KPMG Corporate Finance

W: www.kpmg.ie

T: 01 410 1535

E: neil.collins@kpmg.ie