Adequate housing in Ireland

26th October 2021

Sustainable housing and zero carbon construction

26th October 2021Sustainable business performance of social housing providers

Dedicated professionals want to be held accountable for their ESG credentials. Sustainability has also entered the social housing sector by showing its positive impact on tenants (the S), by meeting serious retrofitting challenges (the E) and by being compliant in a regulatory environment (the G).

Social credentials are distinctive, governance is without discussion. However, the route to net zero carbon will become a bumpy ride: ageing properties, ambitious EU goals and timelines, externalities, and different facts and metrics and various opinions. Although we acknowledge the complexity, this should not become an excuse to delay action by approved housing bodies and local councils in Ireland. We suggest this call for action and response is supported with five guiding principles.

1. Look at two sides of the coin

Yes, decarbonisation of homes is complex and urgent. No, there are no quick fixes (power grid is an externality), but there is low hanging fruit (educate tenants with energy savings to avoid energy poverty) and no excuse to wait for others (government support will only be part of the solution).

Yes, decarbonisation is expensive. No, there is no lack of funding, but it may need re-allocation among new housing delivery, retrofitting and community development to reorganise debt capacity. Moreover, partnerships with investors for cost-rental housing will help.

Yes, private landlords as well as homeowners should also contribute their share. No, social housing providers do not have to be solely responsible.

2. Create opportunities

The social housing sector has a track record of addressing challenges that effect society. It often starts with engagement with government to partner in tackling the issue. However, government will not provide all the answers let alone all funding, although it is likely to wield the stick.

Although decarbonisation affects the entire sector, there will not be a one sector solution. It becomes more evident that appropriate responses require leadership from frontrunners. First movers will turn challenges into business opportunities. And yes, success and failure will alternate as part of ultimate successful innovations.

One of the effective ways to show leadership is to make the individual corporate decarbonisation agenda part of the regular asset management strategy. Then decarbonisation integrates regular business operations of a residential real estate company with a social purpose.

3. Think with the head, act from the heart

The urgency for mitigating climate change comes with many emotions in society, understandably, because society at large may have waited too long. There is increasing awareness of the implications of climate change and there is a growing desire to leave a better world for future generations. However, there is a danger that actions are driven by emotions and less by evidence-based facts. Also, in social and affordable housing we should stay aware, that homes are inert and capital intensive to build, maintain and operate. Sustainability combines capital investment and consumer operation of homes.

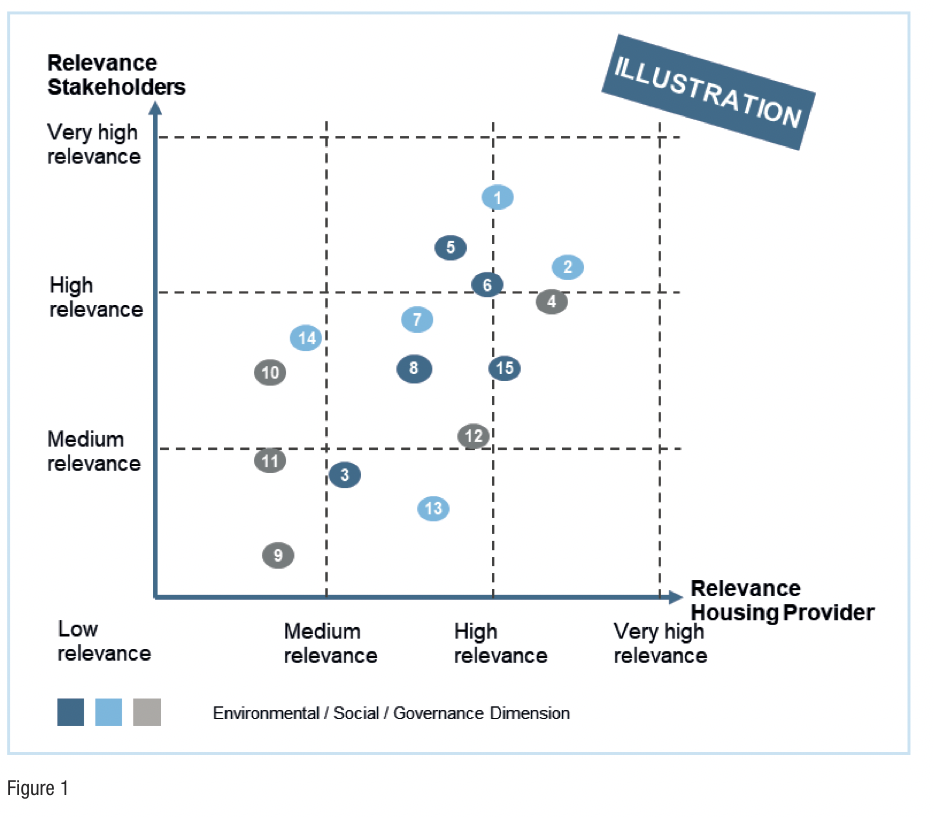

To incorporate and prioritise sustainability responses in a social housing organisation, a materiality analysis can be a useful tool in designing a sustainable implementation strategy (see Figure 1).

4. Follow the money

Because equity does not have access to approved housing bodies in Ireland, debt capital is the main source of funding. And debt capital markets across Europe are showing a fast-growing interest in sustainable related debt instruments such as green, social, and sustainable bonds and sustainability-linked loans. Current ESG investors and new entrants (all working with growing ESG mandates) are increasingly identifying social and affordable housing on their radar.

To support them in their allocations of capital, an ESG accreditation is helpful. We have developed the Certified Sustainable Housing Label that is instrumental in countries across Europe.

In combination with a Sustainable/Social Finance Framework and ESG Reporting (for instance by following the UK Sustainability Reporting Standard), also approved housing bodies in Ireland can become more visible for international ESG investors.

5. Use economies of scale

Due to their sizes, although still relatively modest, approved housing bodies can make a difference in successful retrofitting. House archetypes require different approaches. Pilot projects and other test bedding can lead the way to economies of scale. Scaling can often be aligned with cost reduction and therefore affordability for tenants. And don’t forget, there are no failed pilots: there are always lessons to be learned also how not to proceed.

Two success factors that come with scale: one is to engage tenants in an early stage, to make them aware that a retrofitted home also requires a different behaviour (windows, installations, ventilation). And even more important, prior to retrofitting, a tenant can pick the low hanging fruit by savings in energy consumption. The other is to create a learning environment among housing staff: what works best and how to accomplish that best.

To conclude, we would like to invite the approved housing bodies to further develop pathways to decarbonisation and integrate these in regular business operations. Professional asset management is key.

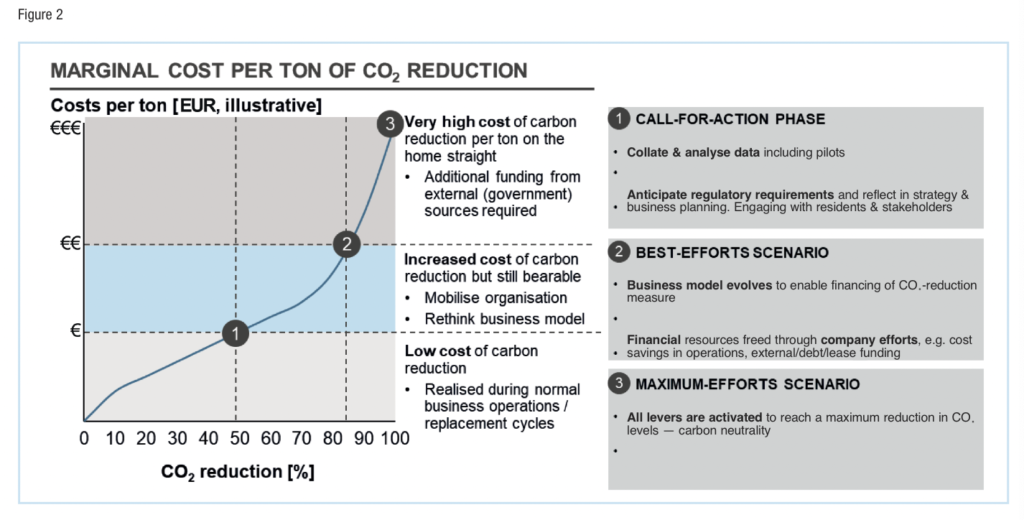

New technologies (particularly in installations) are going to help but are not fully test bedded and available yet. Installations (need alternative power) therefore we need to address both the fabric and the consumer, tenant. The fabric for future proofing the brick and mortar and to control energy poverty. The tenant to engage and ensure they get the maximum benefit from low hanging fruit in energy savings. The graph below (Figure 2) shows an indicative pathway.

E: ad.hereijgers@ritterwald.nl

W: www.sustainable-housing.eu