Measuring liveability

19th July 2017

Navigating Financial Risk

19th July 2017The emergence of Build to Rent

CBRE Director Tim MacMahon examines the potential of the Build to Rent (BTR) concept for Ireland.

Over the last number of years, investors globally have become increasingly interested in ‘alternative’ routes to investment in real estate as they seek to generate better returns and diversify their investment portfolios. Moving away somewhat from the traditional office and retail sectors, which heretofore have dominated investor wish lists, we have seen increased interest in, and demand for, investment in new niche areas of real estate where returns are driven by emerging macro-trends and which as a consequence tend to have countercyclical characteristics.

One of these sectors is Build to Rent (BTR) which is gaining huge traction and has the potential to become very important in an Irish context.

Build to Rent describes the practice of delivering purpose-built residential rental accommodation and associated amenity space that is designed with the sole purpose of being used as long-term rental accommodation and professionally owned and managed by an institutional landlord. The sector has become increasingly attractive to investors, developers and funders alike and considering the severe supply shortages inherent in Dublin and many other Irish cities, it is a sector that we are going to hear a lot more about in the Irish market over the next few years.

The concept of ‘Build to Rent’ is one that is firmly established in many jurisdictions such as the US, where it is now regarded as a mainstream sector offering superior returns to other more traditional forms of investment. Indeed, in 2016, Build to Rent was a $250 billion debt and equity market in the US. More recently, Build to Rent has gained popularity in Europe and in the UK but is as yet only at an embryonic stage in the Irish market. This is about to change as the Irish housing sector becomes professionalised and delivery increasingly supported and delivered by institutional capital.

Investment in multifamily residential (which didn’t exist as a mainstream investment sector in Ireland five years ago) has been increasing in popularity over recent years, accounting for 6 per cent of overall investment spend in Ireland in 2016, up from 4 per cent the previous year. However, many of the buildings that have traded as multifamily investments are conversions of schemes that were originally built with the intention of being sold. The key differentiator between the multifamily concept and Build to Rent is that the latter is designed from the outset with long-term rental in mind.

Build to Rent schemes are generally of a very high quality design and with ready access to amenities such as residents lounges, gyms, entertainment rooms and cinema rooms as well as being located close to good quality public transport nodes. Amenities are generally provided within the overall development with a high degree of public space provided to facilitate socialising and foster community. Good quality in-house management are on hand to take care of maintenance and provide a high level of support for residents within the development. Residents within Build to Rent schemes are willing to pay a premium for the additional benefits that living in a high quality purpose-built scheme that is tailored to their needs offers over traditional rental accommodation. Investors on the other hand are attracted to a sector that offers stable long-term income potential and is less susceptible to cyclical variations than other traditional real estate sectors.

“Build to Rent is as yet only at an embryonic stage in the Irish market but this is about to change.”

CBRE’s Build to Rent Equity Barometer shows that there is £27.7 billion worth of equity targeting the UK Build to Rent (BTR) sector over the next five years and we firmly believe that there is potential for some of this capital to be attracted to invest in Build to Rent in the Irish market. The research suggests that almost half of the capital chasing Build to Rent opportunities in the UK market originates from North America. With the main constraint for investors continuing to be a lack of available stock and the ratio of deployable equity to marketed stock currently at 14:1, some of these investors are now looking for opportunities in the Irish market considering the well-publicised housing shortages prevailing in cities such as Dublin.

Although Ireland has traditionally been associated with high levels of home-ownership, this has been changing over recent decades. Indeed, according to the most recent census of the 2016 population, 29 per cent of citizens are now renting their accommodation, with higher rates observed in the principal cities (36 per cent in Dublin for instance). Over 497,000 households in Ireland are now renting, rebalancing the proportion of households who are owner-occupied vs. renting, from almost an 80:20 split to a 70:30 split (between 2006 and 2016).

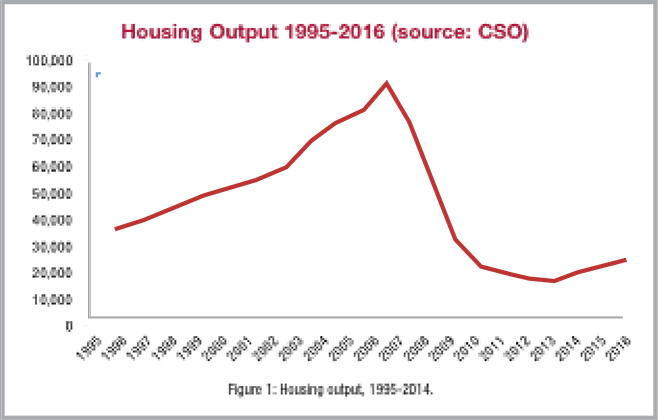

With the general population now more disposed towards renting and severe supply shortages prevailing in capital cities such as Dublin we expect that the Build to Rent sector will grow exponentially over the next few years. The Government are understandably keen to support the development of a large-scale, institutionally funded and professionally managed purpose-built residential accommodation in order to increase and improve the stock of rental accommodation in the Irish market which will also support the development of this new concept over the next few years. Indeed, in the Government’s Rebuilding Ireland – Action Plan for Housing and Homelessness document, there is an acknowledgement that Build to Rent projects can play an important role in addressing critical shortages of rental accommodation in areas of high demand. The Minister for Housing has therefore specifically requested under a Specific Planning Policy Requirement under Section 28 of the Planning Act that planning authorities and An Bord Pleanala prioritise all necessary actions to deliver build to rent housing schemes.

From a funding perspective, domestic and international banks are active in the residential Build to Rent sector, particularly where the schemes are in locations with proven rental demand and the sponsor can demonstrate a high degree of cost certainty. However, they recognise that only certain schemes are optimised for major institutional investors. There are also a number of debt funds with local underwriting teams who are looking to deploy capital into the market. These providers understand the residential supply constraints, which is an advantage over other alternative lenders. There remains a trade-off between the amount of equity committed and the cost and/or covenant terms of the funding facility. Furthermore, the banks have responded to the increased availability of funding from the debt funds to accommodate different sponsor requirements.

There is no doubt but that we will hear more about Build to Rent in an Irish context over the next few years. However, Build to Rent will only be viable in certain locations and on the basis that this asset class is generally assessed, valued, managed, bought and sold in a very different manner to traditional residential investment, there is a steep learning curve involved in getting familiar with this new asset class. The need for professional advice is therefore critical.

Tim MacMahon

Director, Development & Residential Capital Markets

CBRE Ireland

E: tim.macmahon@cbre.com

T: 01 6185 55782

Tim has built up specialist market knowledge on the Build to Rent concept and is currently advising developers, investors and funders who are keen to get involved in Build to Rent in an Irish context. Tim works closely with BTR experts in other CBRE offices in UK, Europe and the USA and recently delivered an address at an international Build to Rent conference in Chicago, USA.