Budget 2024: Government subsidising landlords

31st October 2023

2023 new dwelling targets on track

31st October 2023The Secure Tenancy Affordable Rental investment scheme (STAR)

Fidelma McManus, Partner and Head of Housing with Beauchamps. Anne Doyle, Partner, Housing & Commercial Real Estate.

STAR is a welcome initiative to engage the State with private developers in delivering cost rental housing.

A keen appetite has been demonstrated for cost rental housing based on the over-subscription to existing cost rental schemes and the expectation is that STAR will lead to a significant increase in the availability of cost rental housing, with the obvious associated benefits to those on lower and middle incomes.

What is the objective of STAR

Introduced in August 2023, STAR aims to assist private eligible households while also addressing viability challenges for developments by providing equity investment to stimulate the creation of cost rental accommodation. Private providers, the LDA and AHBs can apply to provide cost rental homes under STAR and the State will make an equity investment in return for designation of the homes as cost rental for at least 50 years, at a rent which shall be at least 25 per cent below market rent.

The scheme aims to invest up to €750 million in the delivery of over 4,000 cost rental homes, which will benefit from secure tenancies and will be let below market rental levels in high demand urban areas. STAR is managed by The Housing Agency and will operate from August 2023 until December 2027.

Eligible tenants

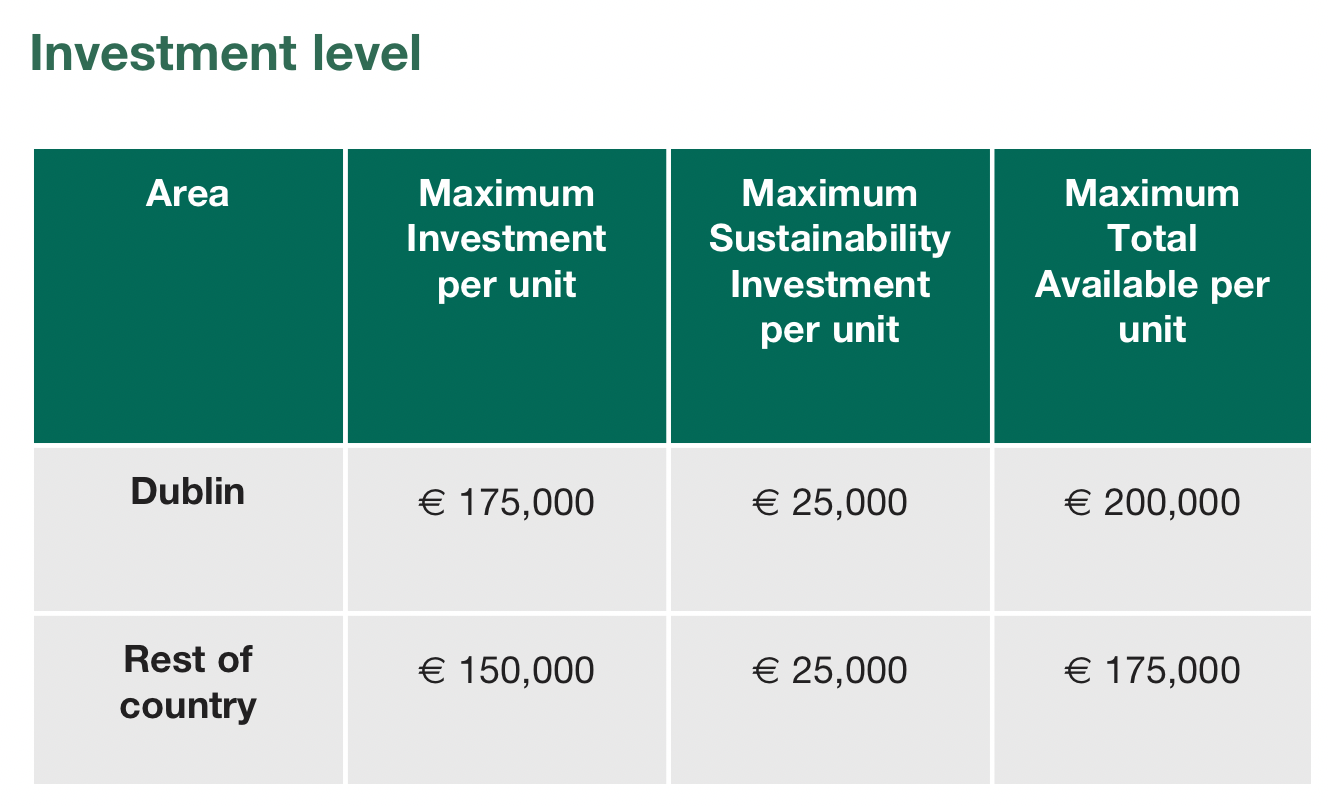

The main eligibility condition for prospective cost rental tenants is based on an annual net income limit at the outset of a tenancy. At the commencement of STAR, an income level of €66,000 net applies for Dublin and €59,000 net applies for the rest of the country, determined by the location of the property.

Units eligible for designation

Units may be in any location of recognised demand. Priority will be given to proposals in respect of units located in urban centres. Proposals must relate to at least 10 units, newly constructed, not previously occupied, and must consist of at least two types of dwelling (one-bed, two-bed etc.) and must include two-bed dwellings.

Who can apply and how?

Any potential providers of cost rental accommodation may apply, including consortiums. For example, a developer may apply by agreement with the intended long-term holder of homes, but the consortium must be led by the long-term owner, operator, and manager of the homes with demonstrable experience in the sector.

The approval process comprises three pre-contract stages:

Stage 1: Expression of Interest (EOI): submit proposal(s) to The Housing Agency in accordance with high-level criteria of the scheme.

Stage 2: Detailed due diligence process leading to eligibility involving a full assessment of costs.

Stage 3: Completion of cost rental investment and equity participation agreement.

The investment will be calculated via an objective open book assessment of developers’ costs and revenues, conducted by The Housing Agency.

Costs will be calculated on generally accepted accounting principles. All revenue derived from the operation of the units will be taken into consideration. The developer will be entitled to a “reasonable profit” (namely the rate of return on capital that would be required by a typical undertaking considering whether or not to provide the service of general economic interest for the whole period of entrustment, taking into account the level of risk).

Investment structure: Cost rental investment and equity participation agreement

Investment will be made in the form of a cost rental investment and equity participation agreement with the developer (the Agreement).

Ownership of the properties will remain with the developer but a charge (subordinated to senior debt as required) will secure the State’s investment. There will be no interest or return payable to The Housing Agency during the term of the Agreement unless there is a breach of the Agreement.

The Agreement will include a right for The Housing Agency to receive a prescribed amount (Property Realisation Equity Share) (PRES), by reference to the following trigger events:

- at the end of the 50-year period, unless the property is again designated as cost rental at that time;

- if the property ceases to be used for cost rental, for whatever reason during the agreement (change in law, damage/destruction to fire etc); and

- breach of the Affordable Housing Act 2021 or the regulations made thereunder.

The PRES is calculated as a percentage of the overall property value, by reference to the aggregate of the equity share contributed to the purchase by the developer and the investment.

As security for the repayment of the PRES, The Housing Agency will take a fixed charge over the property. If a commercial lender is involved in developing, buying or refinancing the purchase of the property, The Housing Agency will permit a first ranking charge for that lender and will take a second ranking charge, subject to intercreditor arrangements.

At the end of the term of the Agreement (50 years) there will be three options:

- extend the Agreement for an agreed period (with the dwellings remaining in cost rental usage);

- make a repayment to The Housing Agency and exit cost rental designation; or

- The Housing Agency may exercise an option to purchase the dwellings from the owner for market value, taking account of the State’s investment in the properties.

Further conditions

- Assignable – a property owner may assign their interest on notice to The Housing Agency provided the rights and obligations under the Agreement and the Cost Rental designation are fully assigned;

- Refinancing is permissible subject to a new intercreditor agreement and PRES being recalculated.

Commentary

The LDA and AHBs have already successfully delivered the cost rental model but this welcome initiative aims to increase funding for these existing players as well as broaden the level of state investment to private developers in a bid to deliver cost rental on a wider scale.

There is likely to be substantial uptake from the existing players, but clarifications are required to determine the likely level of uptake from private developers who will be looking at this from a different lens. These include details around the ability of either party to unilaterally trigger any of the three end of term options, the definition of ‘household’ to broaden eligibility as well as the potential impact from a future change in law or lack of demand.

The devil will really be in the detail as private developers work their way through the nuances, terms and conditions of STAR and weigh up the potential limitations of long-term cost rental designation to their property.

Fidelma McManus, Partner & Head of Housing, Commercial Real Estate (f.mcmanus@beauchamps.ie)

Anne Doyle, Partner, Housing & Commercial Real Estate (a.doyle@beauchamps.ie)