Apprenticeship is no longer the ‘secondary career option’ for young people in Ireland

17th May 2019

Fingal County Council working hard to deliver to meet the needs of everyone in need of social housing support

17th May 2019Ireland’s first social housing PPP bundle

Ireland’s first ever public private partnership (PPP) for the delivery of social housing will provide 534 social homes. This is the first time that the European Investment Bank (EIB) has invested in this type of project. Deputy Director of the National Development Finance Agency (NDFA), Gerard Cahillane, speaks to Odrán Waldron about the PPP project and the particulars of its funding and delivery.

Rebuilding Ireland, Minister for Housing, Planning and Local Government Eoghan Murphy TD’s plan for addressing Ireland’s housing crisis, hinges on a large increase in the delivery of social housing through various mechanisms. The recent announcement of this first bundle of social housing reaching financial close was the latest chapter in a process whereby the Minister hopes to see 10,000 social homes being built per year by 2021.

Could you provide us with some background on the Social Housing PPP Project?

This project is part of the Government’s Rebuilding Ireland plan and is just one of the delivery mechanisms available for facilitating housing delivery in Ireland. It is the first of three bundles to be procured and delivered by the NDFA using a PPP contract.

The contract is for the design, build, finance and operation of social homes. This is the first time that the PPP model is applied to the housing sector. The contract includes the provision of tenancy management services which will be provided by an Approved Housing Body (AHB), i.e. a charitable organisation already established in the provision of social housing.

The Sanctioning Authority for the project is the Department of Housing. Dublin City Council is the Sponsoring Agency and the Lead Local Authority for this first Bundle. The homes being delivered in this project are located in the greater Dublin area with sites on the Malahide Road and in Finglas, Clondalkin, Naas, Dunleer, Co. Louth and Wicklow town.

What is the NDFA’s role in the delivery of Social Housing Bundle 1?

The NDFA is the procuring authority and the financial advisor for the project on behalf of the Department of Housing and the participating local authorities.

As with all NDFA projects, there is a strong corporate governance structure agreed at an early stage. A project board representing the key stakeholders meets regularly for the duration of the project. In the pre- procurement stage, the project board was chaired by Dublin City Council CEO. It is important that the project parameters are well defined at this stage including the scope of the project, any policy considerations, the budget etc. Once the project moved into the Procurement phase, the chair of the project board transferred to the NDFA.

Value for money is something that is central to our role. We have to test if value for money is achievable by comparison of costs against a well established framework. This framework is the public sector benchmark (PSB).

The purpose of the PSB is to calculate the cost of the project as if it was delivered through traditional procurement methods. It is a very detailed financial modelling exercise that includes not only the costs of constructing the homes but also the cost of life cycling and facilities management (including tenancy management) over the 25-year operation period. While the NDFA compiles the PSB, ultimately it is agreed and signed off by the Department before we go to market.

The NDFA develops the tender documentation with the project team and for this project three consortia were shortlisted following receipt of expressions of interest from five candidates. After an extensive tender evaluation process, managed by the NDFA, the Comhar Housing consortium (Macquarie Group Limited, Sisk and Choice Housing) were selected as the preferred tender.

Can you expand on the commercial structure of a PPP contract? What are the benefits to the State of choosing this type of project delivery?

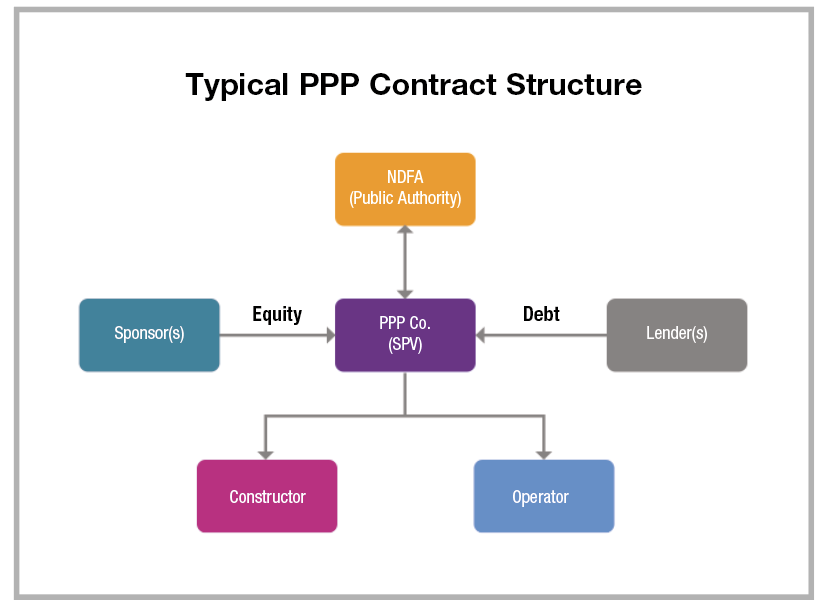

The State enters into a contract with one company (a special purpose company) which must be an Irish registered entity, generally known as PPP Co.

PPP Co. is a private sector consortium selected from the tendering process. The PPP Co. is responsible for the construction of the homes, management and maintenance of the homes. The PPP Co. is also responsible for raising the funding (senior debt & equity) necessary to deliver the project. The EIB has invested 50% of the senior debt required, the first investment by the bank in the social housing PPP sector. The remaining senior debt is provided by Bank of Ireland and the Korean Development Bank.

A PPP is a fixed price contract. Unlike a traditional project contract where construction costs are typically paid upfront in instalments, in a PPP contract the payments are made monthly over the 25 year ‘post construction’ period of the project. The payments are based on the availability of homes and the service performance of PPP Co. This essentially means that, should services fail to meet predefined standards for example, deductions will be made to the monthly payment.

The fixed price nature of the contract means that the State has the certainty of knowing what it will pay over 25 years. The risk of managing and maintaining the homes is passed to the private sector.

At the end of the 25 year period, the relevant local authority retains ownership of the homes which are returned in accordance with the detailed handback requirements that are set out in the PPP contract.

“Value for money is something that is central to our role. We have to test if value for money is achievable by comparison of costs against a well established framework. This framework is the public sector benchmark (PSB).”

This is the first Social Housing PPP in Ireland, is there anything unique to the social housing bundle when compared to other PPP projects?

The key difference in the Social Housing PPP is the provision of tenancy management services by the AHB sector. While the State pays the PPP Co. for the management of the homes, the AHB, as part of the consortium, collects rent from tenants as it is best placed to do so.

Tenant rent is lodged into a joint account set up specifically for the project and it is then passed directly onto the State. This differs from other schemes where housing bodies receive rent from both the State and the tenant.

Could you comment on the role PPPs have played in the delivery of infrastructure in Ireland?

For the record the majority of State infrastructure is not procured using a PPP contract. PPPs are only one of a number of procurement routes used in infrastructure delivery.

PPPs have been widely regarded as being successful in the delivery of the motorway network and the school sector in Ireland. Other sectors where there are PPP projects have delivered infrastructure include health, justice and tourism. Well known landmark buildings that are PPPs include the Dublin Convention Centre, the Courts of Criminal Justice and the Poolbeg incinerator facility.

The PPP model protected the State financially in the case of a schools project which was adversely impacted by the Carillion collapse. To date, the State has not made any payment for the unfinished schools in this particular project and will not do so until the construction of these schools is complete. Three of the schools have been completed since the Carillion collapse and another will be delivered over the coming months. Politically it was a difficult time for the reputation of the PPP model, however the challenges of delivering infrastructure projects is clearly not confined to PPPs. These are general challenges in the infrastructure sector, and not as a result of the procurement route chosen.

What role do you see PPPs playing in future delivery?

Not all projects are suitable for the PPP model and it is essential that a PPP assessment report is undertaken to determine the appropriateness for each individual project, if PPP is being considered as an option.

As the credit rating of Ireland has improved in recent years, substantial funding both from the EIB and other commercial funders is now available to Ireland at very competitive rates for well structured projects. Therefore, from a financing perspective it is a good time to lock in low rates for a 25-year contract life.