Planning pipeline and construction starts

21st July 2020

Housing as an economic stimulus

21st July 2020Pan-European perspective on Ireland’s rental housing challenge

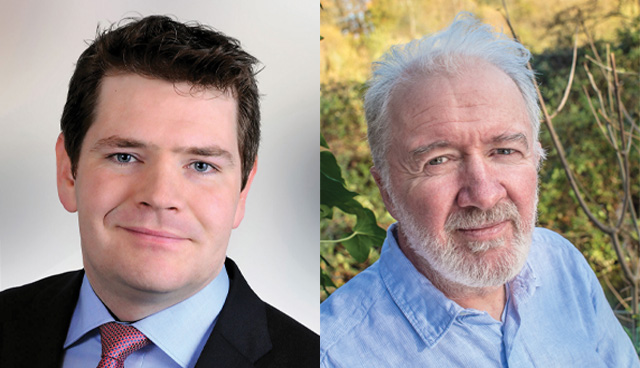

Ad Hereijgers, Business Development Director.

Since 2018, Ritterwald has been developing its housing and real estate consultancy services across selected countries in Europe. Since the launch of its Certified Sustainable Housing Label in Dublin last October, Ritterwald has made further steps in entering the Irish and UK markets, write Ritterwald’s Business Development Director Ad Hereijgers, and UK Director Austen Reid.

Ritterwald already provides in-depth knowledge and expertise to social and affordable housing companies in Germany, the Netherlands and France; three countries with a rich history when it comes to sustainable rental housing, serving households with low, moderate, and middle incomes and tenants with special needs.

Housing affordability gap

Today, Ireland is home to many successful and well-known technology, pharmaceutical and biotech companies worldwide. Prior to Covid-19, Ireland was the fastest growing economy in the EU for several consecutive years in a row. Despite Ireland’s economic redemption from the 2008 global financial crisis, the country remains confronted with a major housing crisis. As urbanisation is growing, supply is not keeping up with housing demand. Although household incomes have been on the rise, high demand is causing housing prices to explode, causing a severe affordability gap. Over the last decade, house prices in Dublin alone almost doubled.

2020 turning point?

2020 marked an important year for the country as the General Election took place. Among different domestic issues, housing stood at the forefront of the election. The new coalition government has created a momentum that places social and affordable housing in the prominent position on the national policy and budget agenda it deserves. From a pan-European perspective, this could also result in the positive re-evaluation of the rental sector, not only as step to first time homeownership, but as a mature and affordable tenure. This re-evaluation could particularly support young singles and couples that prefer living in an urban environment where the employment is.

Strategic perspective

In each EU country, social and affordable housing is being delivered and operated in a regulatory environment. To accomplish its ambitious goals, the new Irish coalition cabinet will have to design an effective regulatory system, that accommodates both new constructions and renovations of social and affordable housing. For future economic prosperity of urban areas such as Dublin and Cork, the rental market becomes ever more important.

Given Ritterwald’s pan-European experience, we would like to suggest three strategic considerations. First, one should design a housing delivery system that can guarantee social housing in the long run; this implies introducing long-term patient financing covering debt capacity by rental income supplemented by subsidies, introducing and enforcing long-term leases with tenant protection, national rent level policies, and designing restricted future sales policies to individual tenants.

Mathias Hain, Managing Director RITTERWALD hands over Certificate of Certified Sustainable Housing Label to Rob Lane, Group Commercial Director Clarion Housing Group.

Second, we believe diversifying housing suppliers is much needed; council housing and Approved Housing Bodies (AHBs) and for-profit providers (PRS). That said, we would encourage further consolidation of AHBs to support greater reliance on private finance. And PRS can contribute after compliance with the Regulation Office.

Lastly, identifying additional and robust public and private funding to accommodate availability (production levels), affordability (rent levels) and accessibility (transparent allocation); to avoid too much pressure on the national exchequer, one could consider tapping into the growing share of ESG investors, who look at social and affordable housing as a low risk asset class – assuming that proper regulatory policies are put in place and enforced by the Regulation Office.

Innovations in social housing

A new cabinet and new policies to recover from the Covid-19 crisis offer opportunities to address housing challenges in an innovative way. The Covid-19 crisis brought us at least one valuable lesson, the adoption of digital communication as the new normal in delivery of customer services. Of course, digitisation was already gaining in importance, but the lockdown has given it further impetus due to severe constrains in face to face communications.

From our pan-European experience, we would like to suggest two important needs that have to be met simultaneously as well as the increase in private finance from banks and ESG investors (pension funds, insurance companies and family offices).

RITTERWALD’s Ad Hereijgers, Sebastian Redder and Lutz Rittig in Frankfurt at 2019 Annual Conference ICMA Green Bond and Social Bond Principles.

First, the supply chain must be well managed; availability of (urban) land, planning procedures and permissions, development capacities and regulatory requirements. Moreover, the supply chain should be aligned with public investments in infrastructure to make new developments, both brownfields and greenfields, accessible by public transportation.

Secondly, an even greater challenge than new construction lies in greening the current existing housing stock to meet climate goals in a timely manner; this can only be done by identifying the balance among rent increase (to cover cost of capital) and smart grants. In return, household’s energy bills can be reduced, and affordability can be increased.

Certified Sustainable Housing Label

Late 2019, the Certified Sustainable Housing Label was launched by Ritterwald in Dublin during the Conference of the European Federation for Living (EFL), co-hosted by Clúid Housing and well attended by other members of the Housing Alliance. It is the first certified methodology to measure the positive impact of social housing companies. Moreover, it provides housing companies with the opportunity to monitor and be aware of their own sustainability performances. The Label, therefore, highlights the significant sustainability impact undertaken by social housing companies to the capital markets and helps them gain access to a wide range of ESG investors. For those social housing companies that will not consider private or public placements, the Label still provides an opportunity to diversify its lender base. Should a company merely want to demonstrate and enhance its sustainability performance, e.g. towards its stakeholders, the company can undergo a sustainability assessment.

Sustainable Business Models

Council housing is funded almost entirely by capital grants which requires the government to pay the full costs of buying or building homes upfront in a lump sum, whereas in other countries the cost of social housing delivery are spread out over the long term by using debt financing (often supported by public loan guarantees). This can make a reliance on Council housing vulnerable in good and bad times; in better times the high cost of land and construction reduces supply while in downturn there tends to be less availability of Government funding. This is not regarded as a sustainable model.

The larger Approved Housing Bodies (AHBs) have built a valuable track record over the years. If the AHBs do consolidate, for reasons for: regulatory and governance requirements, upskilling, economies of scale and better access to funding, they could make a crucial contribution to the growth of the rental housing sector. Because localism and community services are rooted in the DNA of housing companies, one should think of intelligent consolidation to introduce economies of scale taking the ‘human scale’ into account. Money can talk, AHBs can invest and their current and future tenants can benefit.

Ad Hereijgers, Business Development Director

Austen Reid, Director UK

RITTERWALD Consulting

Berlin | Frankfurt | Amsterdam | London

E: ad.hereijgers@ritterwald.nl, austen.reid@ritterwald.co.uk

W: www.ritterwald.eu, www.sustainable-housing.eu